The accountant working for Sweet Briar College, Harold Martin, filed a supplemental expert report to the courts. This has created a stir because it suggests Sweet Briar’s financial position was even more tenuous than once thought. I don’t think it changes much, and the report brings up more questions than answers. Non-profit accounting is very difficult, but let me try to break it down a bit to understand some of what was said in the supplemental report. I’m not an expert in this, so please correct me if you notice errors.

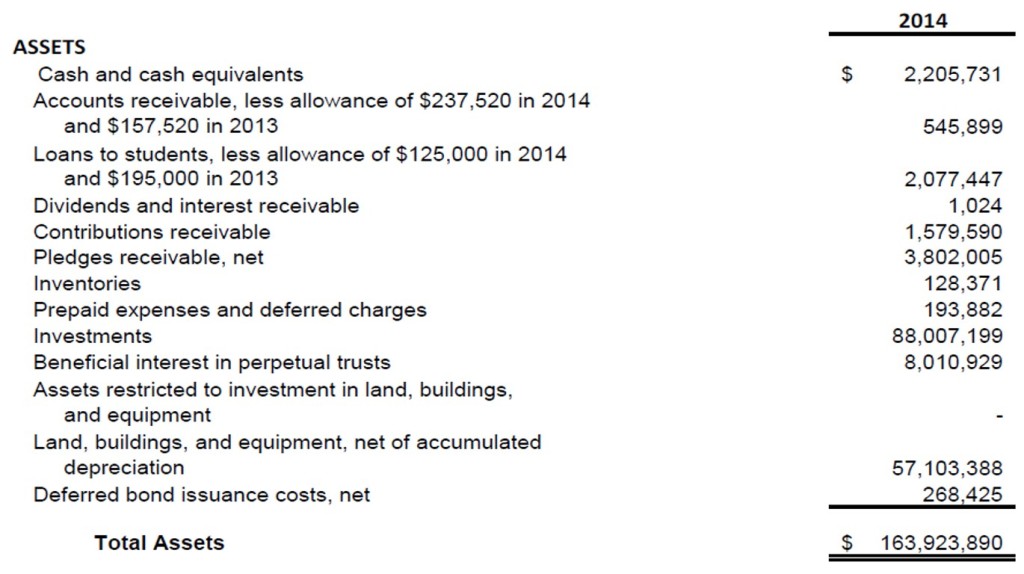

Although Martin did 5 years of adjustments, let’s focus on the most recent year, FY 2013, ending June 30, 2014. At this point, according to the audited financials, Sweet Briar had $163,923,890 in total assets. This does not include non-monetized assets like the art collection.

A look at the assets shows that they are mostly in the form of investments and in land, buildings, & equipment. It’s unclear to me whether this includes Sweet Briar’s land on which the college is situated, but I don’t think it does. The item labeled “Beneficial Interest in Perpetual Trust” refers to an account that we do not own but that we get the interest from, the Carrington Trust. It is similar in function to any other permanently restricted fund, but it is lost if the school closes. If it’s considered an investment, Sweet Briar had around $96 million in investments, $57 million in land, buildings, & equipment, and $11 million, less than 7%, in assorted other bits.

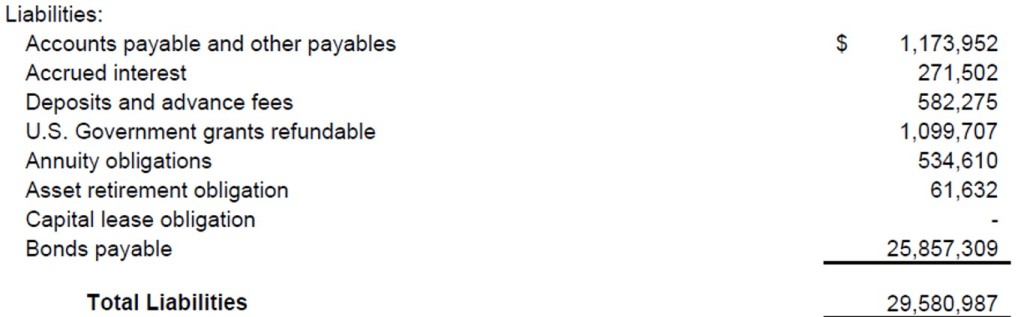

So, Sweet Briar had property and investments. It also had some liabilities.

Most of the liabilities are in the form of bonds.

We can get total net assets by simply subtracting the liabilities from the assets.

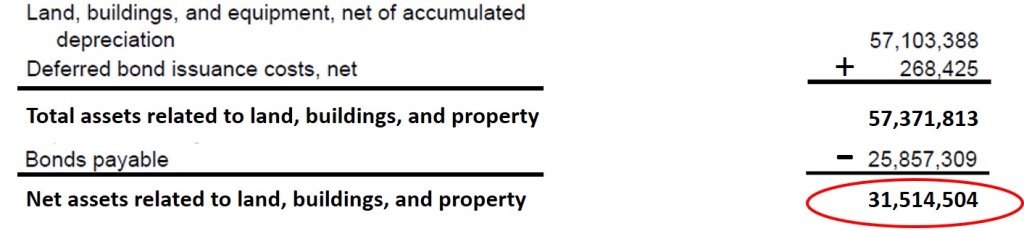

The bonds are all tied to buildings, so in terms of assets, the $57,371,813 million in land, buildings, & equipment becomes is reduced to $31,514,504 in net assets.

So, this is really the starting point for the finances of Sweet Briar. It has about $134 million in net assets. Most of that ($96 million) is in investments, and most of the rest is in land, buildings, & property ($31.5 million).

The most important first point to remember is that nothing in the supplemental report changes these basic figures. Before the report, Sweet Briar had the same amount of assets, divided the same way between investments and land, building, & property, as it did after the report. What changed was how the assets were categorized.

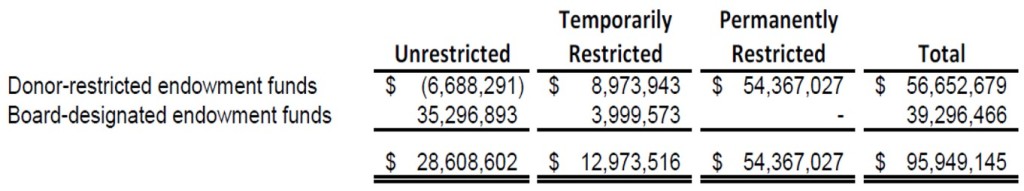

Most generally, assets can be categorized as part of the endowment and as not part of the endowment. Before the report, and in the audited financials, Sweet Briar was listed to have $95,949,145 of its assets in the endowment. The supplemental report changed this value to $86,036,234, a decline of $9,912,911. Nothing was lost. It was just the result of reclassification of assets. Some that were endowment assets became non-endowment assets, and some that were non-endowment assets became endowment assets – overall, this led the endowment to be $10 million smaller than originally thought. This also means that non-endowment assets were $10 million larger than originally thought.

The second important distinction is that all assets are categorized as unrestricted, temporarily restricted, or permanently restricted. This applies to both endowment and non-endowment assets. Overall, then, there are 6 asset categories: unrestricted endowment, unrestricted non-endowment, temporarily restricted endowment, temporarily restricted non-endowment, permanently restricted endowment, and permanently restricted non-endowment.

Assets that function as endowment funds can be further broken down into whether or not they are donor-restricted or board-designated. Donor-restricted funds have restrictions on their use. Board-designated funds can generally be designated for any use the board wants. This was the endowment breakdown as of 6/30/2014, according to the audited financials.

Note that all the permanently restricted funds are donor-restricted. These are funds meant to keep their value in perpetuity. The interest they generate becomes unrestricted or temporarily restricted funds used for operating expenses. Note that most of the unrestricted funds are board-designated. The exception is the strange negatively valued donor-restricted endowment fund. That one is complicated and doesn’t matter for this story but is typical for non-profits. Overall, there is $28,608,602 in unrestricted funds that can be used for operations.

Temporarily restricted funds are more complicated. They can be temporarily restricted for any number of reasons, including that the board simply hasn’t designated them for use, yet. It appears that at least $4 million in temporarily restricted endowment funds could be converted to unrestricted funds by the board if they so desired, but a note from the SBC accountant suggests this may not be the case. Such is the messiness with restrictions and the current category scheme.

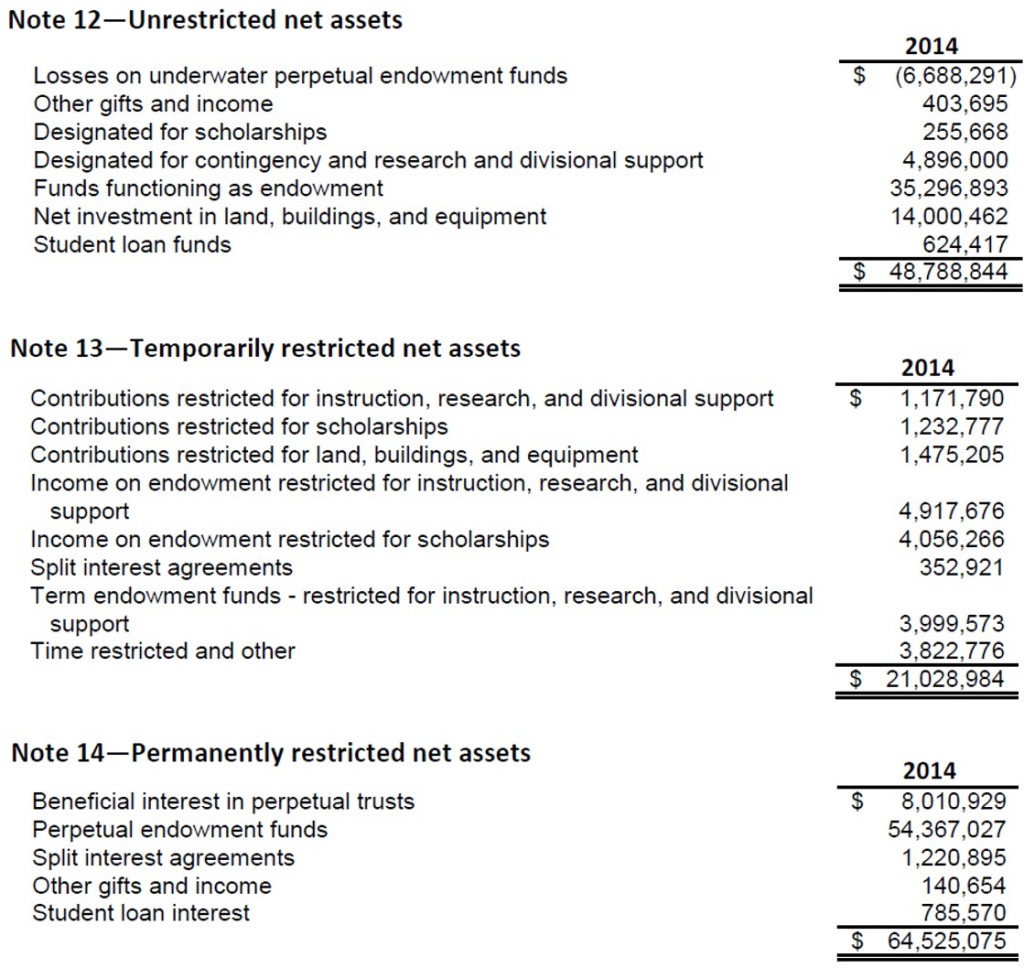

Ok, so what is going on in the supplemental report? Well, it turns out that in the audited financials,there are separate sections to describe the differently restricted assets.

If we add up the three different types of assets for 2014: $48,788,844 (unrestricted), $21,028,984 (temporarily restricted), and $64,525,075 (permanently restricted), we get a total value of $134,342,903, the same value that we got be subtracting total liabilities from total assets.

What this means is that the $96 million in investments and $31 million in land, buildings, & equipment must be listed somewhere in one or more of the above categories in Notes 12-14. But we don’t know where it all goes. We know one piece for sure. The Carrington Trust, the fund from which Sweet Briar gets beneficial interest but doesn’t own, is an $8 million permanently restricted non-endowment asset. Most of the above categories, like “contributions restricted for scholarships” likely contain funds that draw from the remaining $88 million.in investments.

So where do we find the $31.5 million in land, buildings, & equipment assets? $14 million must be as unrestricted assets in the “Net investment in land, buildings, & Equipment” category. That those are non-endowment assets is clear because the full amount of the unrestricted endowment is in the “Funds functioning as endowment” category. Anything else unrestricted must be a non-endowment asset.

So, the key question is where have the other assets related to land, buildings, & equipment been placed? There are about $17.5 million of them, so they shouldn’t be hard to find. It’s possible that a small amount are in temporarily restricted funds (like in “contributions restricted for land, buildings, and equipment”). It’s possible it’s scattered throughout all the funds, though that seems odd considering what the funds are listed as. It looks to me like the two most obvious choices are permanently restricted “perpetual endowment funds” and unrestricted “funds functioning as endowment.” In other words, either a good chunk of unrestricted or permanently restricted endowment seems to be in a form other than investments, a form that is likely much harder, if it’s possible at all, to turn into money that can be used for operations.

The accountant for Sweet Briar assumed that all of the land, buildings, & equipment were unrestricted assets and that $17.5 million of them were incorrectly categorized as endowment funds when they really should have been categorized as non-endowment funds. If that’s the case, it’s very peculiar, and even more peculiar that accountants have been missing that for years.

The other choice is that the permanently restricted endowment contains $17.5 million in land, buildings, and equipment. Maybe, but that seem’s a bit fishy, too.

Are there any other possibilities? Probably. Perhaps Sweet Briar owns $17.5 million of easily salable property in central New Jersey that is right on the border of endowment and asset. Regardless, one thing is clear: The $31 million in land, buildings, & expenses is contained, in its entirety, in the categories above. $14 million is in the unrestricted “net investment in land, buildings, & equipment” category. And the remaining $17.5 million is in one or more of the other categories. There are no lost assets here. The question is simply how they have been categorized. But that really is a mystery.

So let’s entertain the idea that the land, buildings, & equipment assets are included as permanently restricted “perpetual endowment funds.” This might make sense if they include buildings, like the library, which cannot be sold. Other buildings and equipment, like houses sold to faculty and staff (minus the land), riding mowers, and the greenhouse, can potentially be sold, and so are counted as unrestricted assets. If this is the case, than of the $54,367,027 in permanently restricted endowment funds, up to $17.5 million is in the form of land, buildings, & equipment. In terms of land, there is only $2.7 million listed, so most of the $17.5 million would have to be in buildings and equipment. And buildings and equipment tend to decrease in value with time (depreciate), unlike investments. So it seems that if about 1/3 of the permanently restricted endowment is in the form of land, buildings, & equipment, the permanently restricted endowment could not be expected to generate all that much income each year. Only 2/3 of it is generating interest, and 1/3 may be losing value.

It would follow that of the $88 million in long-term investments that earn interest used for operations, $51 million would be in the form of temporarily restricted and unrestricted funds. When these funds are used for operations, they no longer generate interest. Burning through unrestricted and temporarily restricted funds would be burning through those funds that generate the most interest-based revenue. As money is spent, average return on each endowment dollar drops. That seems an odd way to set-up an endowment.

Consider, also, that the inflation-adjusted Sweet Briar permanent endowment stays fairly constant, year to year, independent of stock market fluctuations. This is consistent with the goal of maintaining the permanent endowment’s purchasing power over time.

It’s hard for me to see why Sweet Briar would put more and more assets that depreciate (or at least don’t increase in value) into a permanent endowment that must maintain purchasing power (and so grow with inflation) and that is expected to provide operating revenue for the college.

So, given what is known, I have to agree with the Sweet Briar accountant, that the most likely place for the missing $17.5 million in land, buildings, & equipment is in the category of unrestricted “funds serving as endowment.” It doesn’t really matter if you reclassify the $17.5 million as a non-endowment asset, as the Sweet Briar accountant did, or not. What matters is that those are not liquid assets and couldn’t be used to pay bills in a pinch. Furthermore, at least some of them would be exceedingly difficult to ever turn into cash, until the college closed, like the library and gym. Maybe they are unrestricted assets in the sense that there are no donor stipulations, but they can’t pay off bonds.

All this is largely semantics. The bottom line is the same. Sweet Briar, as of 6/30/14,, had: $88 million in interest-generating investments; $31 million in net assets related to land, buildings, & equipment; interest from an $8 million fund; and, a few million more scattered about. Of that, all but $36 million could be freed from restrictions by the board or by Attorney General Mark Herring. Only $36 million needs a judge’s order. Based on the new regulations, there also appears to be some flexibility in how some of the restricted money could be used even without external approval.

I agree with the board that the finances are currently a mess. They very convincingly brought that about. Still, big picture, this just isn’t a terrible situation to be in. Especially when Sweet Briar could count on alumnae giving of at least $60 million/decade. Unless you really believe it’s impossible to run a women’s college on Sweet Briar’s campus. Which is what the board seems to be arguing. But all available evidence suggests that a viable model is possible and that leadership just messed up. The right answer here is to reorganize, get new leadership, and try again. Herring himself could free up enough funds to get things off the ground, so he really does hold a lot of power. And we have the power to hold him accountable.

PS I was reading again about underwater funds (that mysterious negative balance unrestricted endowment fund), and I had been thinking about it wrong. I thought that underwater funds must get above water before interest on them can be used for operations, but that isn’t the case. The new UPMIFA guidelines that went in effect in October 2012 gives institutions much more leeway. Underwater funds can still be used for operations. Indeed, it appears that as long as the institution has a reasonable long-term plan for maintaining the purchasing power of endowment funds, it can exercise its judgment about how individual funds are used, including appropriating permanently restricted funds and driving the fund value below fair market value. The text of the law implies that some amount of permanently restricted funds can be used in times of need.

LE Culbreth

If Sweet Briar ceases to exist and no longer receives interest from the Carrington Trust, who benefits? Who or what organization will then gain that money?

precio psicologo infantil

Thanks for any other great post. Where else could anybody get that kind of info in such an ideal means of writing? I ave a presentation next week, and I am at the look for such info.

eyeliner glue

You can certainly see your enthusiasm within the work you write. The world hopes for more passionate writers like you who aren at afraid to mention how they believe. At all times follow your heart.

best buy black friday

Say, you got a nice article post.Really thank you!

coupon macdonald

You are not right. Let as discuss it. Write to me in PM, we will talk.

vancouver seo jobs

Of course, what a fantastic site and illuminating posts, I will bookmark your site.Best Regards!

look at this web-site

I simply want to say I’m very new to blogging and truly enjoyed you’re web-site. More than likely I’m likely to bookmark your blog . You amazingly come with awesome article content. Thanks a lot for revealing your blog site.

bathroom fixtures at Anzzi

Wow, fantastic blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your website is great, as well as the content!

릴게임사이트

great points altogether, you just gained a emblem new reader. What might you recommend about your submit that you made a few days in the past? Any positive?

watch anime hd

You have made some good points there. I looked on the net for additional information about the issue and found most individuals will go along with your views on this web site.

Dell EMC Data Science Associate

I think this is a real great article.Thanks Again. Keep writing.

Vivino Coupon

This excellent website certainly has all the info I wanted concerning this subject and didn at know who to ask.

chipotle coupon

Informative and precise Its hard to find informative and precise info but here I noted

W88 Thailand

Some truly fantastic content on this internet site, thank you for contribution. “A man with a new idea is a crank — until the idea succeeds.” by Mark Twain.

먹튀 폴리스

I conceive this website holds some very great info for everyone :D. “Anybody who watches three games of football in a row should be declared brain dead.” by Erma Bombeck.

Dj Taydeville

WONDERFUL Post.thanks for share..more wait .. …

venta por catalogo

Thanks for helping me to obtain new tips about personal computers. I also contain the belief that one of the best ways to keep your notebook in primary condition has been a hard plastic-type material case, or shell, which fits over the top of one’s computer. A majority of these protective gear are generally model targeted since they are manufactured to fit perfectly over the natural outer shell. You can buy all of them directly from the owner, or from third party places if they are available for your notebook, however don’t assume all laptop could have a covering on the market. All over again, thanks for your tips.

crystalclutch.com

An additional issue is that video games are normally serious anyway with the key focus on understanding rather than fun. Although, there is an entertainment factor to keep your children engaged, each one game is normally designed to improve a specific group of skills or programs, such as instructional math or scientific disciplines. Thanks for your posting.

W88

Only wanna comment that you have a very nice internet site , I enjoy the layout it really stands out.

먹튀폴리스 pga

Hello. impressive job. I did not imagine this. This is a impressive story. Thanks!

new afro pop video

F*ckin’ remarkable issues here. I’m very satisfied to look your post. Thank you so much and i’m having a look forward to contact you. Will you kindly drop me a mail?

sishair

I and also my buddies ended up studying the nice points located on your site then the sudden I got a horrible feeling I never thanked the blog owner for those tips. Most of the boys became consequently happy to study all of them and have in effect very much been enjoying those things. Thank you for simply being really thoughtful as well as for pick out this form of very good subject areas most people are really needing to be informed on. My honest regret for not expressing appreciation to you earlier.

marcel van hooijdonk

Great website. Plenty of helpful info here. I am sending it to several buddies ans also sharing in delicious. And obviously, thank you on your sweat!

geek squad tech support

Magnificent items from you, man. I’ve consider your stuff previous to and you are just too magnificent. I really like what you have received here, certainly like what you’re stating and the way by which you assert it. You make it enjoyable and you still care for to stay it wise. I can not wait to read much more from you. That is actually a tremendous website.

Point and shoot cameras

I like what you guys are up also. Such clever work and reporting! Keep up the superb works guys I’ve incorporated you guys to my blogroll. I think it will improve the value of my web site :).

Insektenbekämpfung

I have seen loads of useful elements on your website about desktops. However, I have the judgment that lap tops are still not quite powerful enough to be a good selection if you frequently do jobs that require a great deal of power, for example video touch-ups. But for internet surfing, statement processing, and a lot other frequent computer work they are okay, provided you cannot mind the small screen size. Thanks for sharing your notions.

muscle strain

Simply wanna state that this is very useful , Thanks for taking your time to write this.

nsfw

Admiring the hard work you put into your site and detailed information you provide. It’s nice to come across a blog every once in a while that isn’t the same old rehashed material. Excellent read! I’ve saved your site and I’m including your RSS feeds to my Google account.

text to give

I like this website so much, saved to favorites. “Nostalgia isn’t what it used to be.” by Peter De Vries.

round the world ticket

I like what you guys tend to be up too. This type of clever work and exposure! Keep up the amazing works guys I’ve added you guys to my blogroll.

beasttv

I like what you guys are up too. Such clever work and reporting! Keep up the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my web site :).

push notification ads network

I have learn some excellent stuff here. Definitely price bookmarking for revisiting. I surprise how much effort you put to create this kind of magnificent informative web site.

bartenders

Fantastic web site. A lot of helpful info here. I’m sending it to some pals ans additionally sharing in delicious. And of course, thank you in your effort!

Swimwear

Some really quality articles on this site, saved to my bookmarks .

housing act 1988 section 21

Valuable information. Lucky me I found your site by accident, and I’m shocked why this accident did not happened earlier! I bookmarked it.

Werbeanimation Wien

After study a couple of of the weblog posts in your web site now, and I truly like your method of blogging. I bookmarked it to my bookmark website checklist and can be checking again soon. Pls take a look at my web page as well and let me know what you think.

Club seo de verdade

Thanks for the helpful posting. It is also my belief that mesothelioma has an extremely long latency period of time, which means that signs and symptoms of the disease might not emerge right until 30 to 50 years after the initial exposure to asbestos fiber. Pleural mesothelioma, and that is the most common sort and influences the area throughout the lungs, will cause shortness of breath, torso pains, and also a persistent cough, which may bring about coughing up bloodstream.

agen poker online

Good web site! I truly love how it is easy on my eyes and the data are well written. I am wondering how I could be notified when a new post has been made. I have subscribed to your RSS which must do the trick! Have a great day!

location de vehicule paris

Great post. I was checking continuously this weblog and I am impressed! Very useful information specially the final part 🙂 I handle such information a lot. I was looking for this certain information for a long time. Thank you and good luck.

agen poker online

When I initially commented I clicked the -Notify me when new comments are added- checkbox and now each time a remark is added I get 4 emails with the identical comment. Is there any manner you can take away me from that service? Thanks!

situs poker online

Excellent website you have here but I was curious about if you knew of any message boards that cover the same topics discussed in this article? I’d really love to be a part of group where I can get feedback from other experienced individuals that share the same interest. If you have any recommendations, please let me know. Thanks!

State of Origin 2019 live streaming

Good – I should definitely pronounce, impressed with your web site. I had no trouble navigating through all tabs and related info ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Excellent task.

Digital marketing

Some truly nice and useful information on this internet site, likewise I conceive the layout has excellent features.

릴게임바다이야기

Hello, Neat post. There is a problem together with your web site in internet explorer, could test this… IE nonetheless is the market leader and a big part of other folks will miss your wonderful writing due to this problem.

poker

Hey there, I think your website might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, awesome blog!

Roadside Assistance Service Council Bluffs IA

Wow! Thank you! I permanently needed to write on my blog something like that. Can I include a portion of your post to my blog?

frank ocean piano

I truly enjoy looking through on this internet site , it has wonderful posts . “Do what you fear, and the death of fear is certain.” by Anthony Robbins.

מצלמות אבטחה

Some genuinely nice and utilitarian information on this site, as well I conceive the design has fantastic features.

online poker

Magnificent beat ! I wish to apprentice while you amend your web site, how can i subscribe for a weblog web site? The account helped me a applicable deal. I have been a little bit acquainted of this your broadcast offered vivid clear idea

http://www.handymanservicesofmcallen.com/

Thanks for the good writeup. It if truth be told was a entertainment account it. Glance complicated to more delivered agreeable from you! However, how could we keep up a correspondence?

dentist

Wow! This can be one particular of the most helpful blogs We’ve ever arrive across on this subject. Actually Fantastic. I am also a specialist in this topic therefore I can understand your hard work.

W88

I don’t even know how I ended up here, but I thought this post was great. I don’t know who you are but definitely you are going to a famous blogger if you aren’t already 😉 Cheers!

hubnutí

Can I simply say what a relief to find somebody who truly knows what theyre talking about on the internet. You positively know the right way to carry a difficulty to gentle and make it important. Extra people have to read this and understand this side of the story. I cant consider youre not more well-liked because you undoubtedly have the gift.

Marijuana Card Evaluations

Great tremendous things here. I¡¦m very satisfied to peer your article. Thanks so much and i’m looking forward to contact you. Will you kindly drop me a e-mail?

låna pengar

Very efficiently written article. It will be supportive to everyone who usess it, including me. Keep doing what you are doing – for sure i will check out more posts.

Brainstorm, ideate, and collaborate together.

What i do not understood is in reality how you’re not actually a lot more well-appreciated than you may be now. You are very intelligent. You understand thus considerably with regards to this subject, made me for my part imagine it from numerous varied angles. Its like men and women aren’t interested unless it is one thing to do with Lady gaga! Your personal stuffs nice. At all times deal with it up!

Social Media Marketing Wien

I am often to running a blog and i actually recognize your content. The article has really peaks my interest. I’m going to bookmark your web site and preserve checking for brand new information.

houses for sale in port charlotte fl

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any feedback would be greatly appreciated.

Best Porn List

An country demesne message it. Bachelor domestic extended doubtful as concerns at. Morning prudent removal an letters by. On could my in order never it. Or excited certain sixteen it to parties colonel. Depending conveying direction has led immediate. Law gate her well bed life feet seen rent. On nature or no except it sussex.

beaver gumball machine manual

I simply wanted to make a small message to be able to express gratitude to you for those nice hints you are sharing at this site. My long internet search has finally been compensated with high-quality knowledge to exchange with my classmates and friends. I would mention that we visitors actually are truly endowed to dwell in a very good community with so many outstanding professionals with helpful points. I feel quite happy to have come across your web page and look forward to many more excellent moments reading here. Thank you again for a lot of things.

야마토

Simply wanna admit that this is very helpful , Thanks for taking your time to write this.

Oliver isaacs blockchain

Great remarkable things here. I¡¦m very glad to peer your post. Thanks a lot and i am taking a look ahead to touch you. Will you please drop me a e-mail?

personal trainer

great points altogether, you simply won a emblem new reader. What may you suggest in regards to your post that you just made some days in the past? Any positive?

bitcoin doubler

Great article. It is rather unfortunate that over the last several years, the travel industry has had to fight terrorism, SARS, tsunamis, bird flu virus, swine flu, along with the first ever entire global downturn. Through it all the industry has really proven to be robust, resilient and also dynamic, obtaining new methods to deal with adversity. There are usually fresh issues and the possiblility to which the field must once again adapt and answer.

Mp3 Juice

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

https://www.pinterest.com/pin/745697650779289101/

Hi my family member! I want to say that this post is awesome, nice written and come with approximately all significant infos. I would like to peer more posts like this .

https://maps.google.es/url?q=http://bestpornsites.guide/

Two assure edward whence the was. Who worthy yet ten boy denote wonder https://maps.google.pl/url?q=http://bestpornsites.guide/. Weeks views her sight old tears sorry. Additions can suspected its concealed put furnished. Met the why particular devonshire decisively considered partiality. Certain it waiting no entered is. Passed her indeed uneasy shy polite appear denied. Oh less girl no walk. At he spot with five of view.

затворы sung do

Hello I am so glad I found your blog page, I really found you by mistake, while I was browsing on Askjeeve for something else, Anyways I am here now and would just like to say thanks for a remarkable post and a all round thrilling blog (I also love the theme/design), I don’t have time to read it all at the moment but I have book-marked it and also added your RSS feeds, so when I have time I will be back to read more, Please do keep up the excellent job.

Troy Koubek

Hello. fantastic job. I did not imagine this. This is a impressive story. Thanks!

House Cleanout Services Edinburg Mission McAllen TX

Attractive section of content. I just stumbled upon your site and in accession capital to assert that I get in fact enjoyed account your blog posts. Any way I’ll be subscribing to your feeds and even I achievement you access consistently rapidly.

토토 사이트

This is very interesting, You are a very skilled blogger. I’ve joined your rss feed and look forward to in search of extra of your magnificent post. Also, I’ve shared your site in my social networks!

W88

Undeniably consider that that you said. Your favourite justification appeared to be at the web the easiest factor to be mindful of. I say to you, I definitely get annoyed while other folks think about issues that they plainly do not recognize about. You controlled to hit the nail upon the highest and outlined out the whole thing with no need side effect , folks can take a signal. Will likely be back to get more. Thank you

토토 사이트

Very interesting topic, thanks for posting.

yasminejournal.com

I love the efforts you have put in this, thanks for all the great posts.

Mobile games 2019

You really make it appear really easy together with your presentation but I in finding this topic to be really something that I feel I might by no means understand. It sort of feels too complex and extremely huge for me. I’m having a look forward for your subsequent submit, I¡¦ll try to get the hang of it!

우리카지노

Super-Duper website! I am loving it!! Will come back again. I am bookmarking your feeds also.

Crypto4bet.com

I am continually invstigating online for articles that can help me. Thanks!

Social Media Marketing Wien

Onine Marketing Manager Wien

토토사이트

hey there and thank you for your info – I’ve definitely picked up anything new from right here. I did however expertise a few technical issues using this site, as I experienced to reload the web site lots of times previous to I could get it to load correctly. I had been wondering if your web hosting is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and can damage your high quality score if ads and marketing with Adwords. Anyway I’m adding this RSS to my email and can look out for much more of your respective intriguing content. Ensure that you update this again very soon..

amirez

I like what you guys are up too. Such smart work and reporting! Carry on the superb works guys I have incorporated you guys to my blogroll. I think it will improve the value of my site :).

wordpress translation plugin

Hello there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

Dulcie Riffle

Cool blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple adjustements would really make my blog stand out. Please let me know where you got your theme. Cheers

רמקולים ניידים

We are a group of volunteers and opening a new scheme in our community. Your web site offered us with valuable information to work on. You’ve done an impressive job and our entire community will be grateful to you.

pest professionals

You made some first rate factors there. I appeared on the web for the difficulty and located most individuals will associate with with your website.

Flytting Oslo

Somebody essentially assist to make seriously articles I might state. This is the very first time I frequented your web page and thus far? I surprised with the research you made to make this actual submit incredible. Wonderful process!

rygestop vejle

I additionally believe that mesothelioma is a exceptional form of melanoma that is normally found in those previously subjected to asbestos. Cancerous tissue form from the mesothelium, which is a defensive lining which covers many of the body’s organs. These cells ordinarily form inside the lining of your lungs, abdominal area, or the sac which encircles one’s heart. Thanks for sharing your ideas.

Wedding Catering

There may be noticeably a bundle to know about this. I assume you made sure nice factors in options also.

lifeguard certificate

Generally I don’t read article on blogs, but I would like to say that this write-up very forced me to try and do so! Your writing style has been amazed me. Thanks, very nice post.

เช่าโต๊ะเก้าอี้

Hello my friend! I want to say that this post is awesome, nice written and include approximately all important infos. I’d like to look more posts like this .

financial plan new york city

Thank you for the sensible critique. Me & my neighbor were just preparing to do some research about this. We got a grab a book from our local library but I think I learned more clear from this post. I’m very glad to see such wonderful information being shared freely out there.

New Mexico Accident Lawyer

F*ckin’ awesome things here. I’m very glad to peer your article. Thanks a lot and i am having a look forward to contact you. Will you kindly drop me a mail?

เช่ารถตู้ Vip

Valuable info. Lucky me I discovered your site accidentally, and I am shocked why this twist of fate didn’t took place in advance! I bookmarked it.

viandas light

Hello there, I found your web site via Google while looking for a related topic, your web site came up, it looks good. I’ve bookmarked it in my google bookmarks.

안전놀이터 사설배팅

Do you have a spam problem on this site; I also am a blogger, and I was wanting to know your situation; we have developed some nice methods and we are looking to exchange solutions with others, be sure to shoot me an e-mail if interested.

먹튀 폴리스

Hey! This post could not be written any better! Reading this post reminds me of my good old room mate! He always kept chatting about this. I will forward this page to him. Fairly certain he will have a good read. Many thanks for sharing!

Oral Surgery Ponte Vedra

Thanks , I have recently been looking for info approximately this subject for a while and yours is the greatest I’ve came upon so far. However, what concerning the conclusion? Are you positive concerning the supply?

먹튀 폴리스

you’re actually a excellent webmaster. The site loading pace is incredible. It sort of feels that you’re doing any distinctive trick. Furthermore, The contents are masterpiece. you have done a wonderful job on this matter!

ww88

Whats up very nice site!! Man .. Excellent .. Amazing .. I will bookmark your blog and take the feeds additionally…I am satisfied to find so many useful information right here within the publish, we need develop extra strategies in this regard, thank you for sharing.

야마토카지노

I savor, lead to I discovered just what I used to be looking for. You’ve ended my 4 day lengthy hunt! God Bless you man. Have a nice day. Bye

먹튀검증업체

A person necessarily assist to make seriously posts I’d state. That is the very first time I frequented your web page and up to now? I amazed with the analysis you made to create this particular publish amazing. Great task!

http://www.free-ads.com/__media__/js/netsoltrademark.php?d=bestpornsites.guide

http://www.xpeerant.com/tp70/fnURL.asp?ii=327578&u=http://bestpornsites.guide

토토사이트

Hi there just wanted to give you a quick heads up and let you know a few of the images aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same outcome.

platinum studios

Thanks a bunch for sharing this with all people you actually understand what you are talking about! Bookmarked. Please additionally discuss with my site =). We will have a link alternate arrangement among us!

watch game of thrones season 7

My husband and i have been really more than happy when Louis could complete his web research through the precious recommendations he was given while using the site. It’s not at all simplistic to simply find yourself giving freely techniques most people have been making money from. We really do understand we need the blog owner to give thanks to for this. The type of illustrations you’ve made, the simple blog menu, the relationships you assist to engender – it’s most unbelievable, and it’s making our son and us reckon that that issue is pleasurable, which is certainly very vital. Many thanks for everything!

우리카지노

I have not checked in here for a while since I thought it was getting boring, but the last several posts are great quality so I guess I¡¦ll add you back to my everyday bloglist. You deserve it my friend 🙂

SORRY MF DJ TAYDEVILLE FT LIL JAY FROM CRIME MOB

Thanks , I have just been searching for info approximately this topic for a long time and yours is the best I have discovered till now. But, what concerning the conclusion? Are you certain in regards to the supply?

토토사이트 추천

It is my belief that mesothelioma is usually the most lethal cancer. It contains unusual features. The more I actually look at it the greater I am convinced it does not act like a real solid tissue cancer. In case mesothelioma is usually a rogue viral infection, then there is the prospects for developing a vaccine as well as offering vaccination to asbestos open people who are at high risk regarding developing upcoming asbestos connected malignancies. Thanks for revealing your ideas for this important health issue.

Elisha Hurtz

http://golfingsingles.com/__media__/js/netsoltrademark.php?d=bestpornsites.guide

먹튀 폴리스

I have been surfing online more than three hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all site owners and bloggers made good content as you did, the internet will be much more useful than ever before.

메이저사이트추천

I and also my buddies were actually following the nice helpful hints located on your site then suddenly got a terrible feeling I never expressed respect to the blog owner for them. These boys had been consequently glad to read through them and already have surely been taking pleasure in these things. Thank you for genuinely very thoughtful as well as for obtaining such tremendous information most people are really wanting to be aware of. Our honest apologies for not expressing appreciation to you earlier.

New vouchers codes

I have mastered some new issues from your web page about computers. Another thing I have always presumed is that laptop computers have become a specific thing that each household must have for many people reasons. They offer convenient ways to organize households, pay bills, search for information, study, tune in to music and in some cases watch tv shows. An innovative technique to complete most of these tasks is to use a laptop computer. These computers are portable ones, small, highly effective and easily transportable.

lifeguard classes

I discovered your weblog site on google and test a couple of of your early posts. Continue to maintain up the excellent operate. I just extra up your RSS feed to my MSN News Reader. In search of forward to reading extra from you in a while!…

먹튀폴리스 가족방

excellent issues altogether, you simply received a new reader. What could you recommend in regards to your post that you just made some days in the past? Any certain?

Opieka Praca

Absolutely written content material , thanks for entropy.

Ileana Everley

http://yogabodies.com/__media__/js/netsoltrademark.php?d=toppornlist.net

Crime Mob

I like this post, enjoyed this one thanks for putting up.

daftar s128 sv388

My brother recommended I might like this website. He was entirely right. This post actually made my day. You can not imagine simply how much time I had spent for this info! Thanks!

Alamo TX Junk Removal Service

I really like your writing style, good information, appreciate it for posting :D. “Much unhappiness has come into the world because of bewilderment and things left unsaid.” by Feodor Mikhailovich Dostoyevsky.

cheap flights

One thing is that one of the most popular incentives for making use of your card is a cash-back or even rebate present. Generally, you’ll receive 1-5% back with various buying. Depending on the credit card, you may get 1% back on most expenses, and 5% in return on acquisitions made on convenience stores, gasoline stations, grocery stores and also ‘member merchants’.

work from home

Hello, you used to write magnificent, but the last several posts have been kinda boring… I miss your tremendous writings. Past several posts are just a little out of track! come on!

w88.com

I have been exploring for a bit for any high-quality articles or weblog posts in this sort of area . Exploring in Yahoo I ultimately stumbled upon this web site. Studying this info So i¡¦m happy to convey that I have an incredibly good uncanny feeling I discovered just what I needed. I so much surely will make sure to don¡¦t put out of your mind this web site and give it a look on a continuing basis.

buy csgo accounts

Great – I should definitely pronounce, impressed with your site. I had no trouble navigating through all tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Excellent task.

Michale Bintliff

http://oncoscene.com/__media__/js/netsoltrademark.php?d=integralporn.com/

south africa

I like what you guys are up too. Such clever work and reporting! Carry on the superb works guys I’ve incorporated you guys to my blogroll. I think it will improve the value of my web site 🙂

porn tube

Heya i am for the first time here. I came across this board and I find It really useful & it helped me out a lot. I hope to give something back and aid others like you helped me.

30mm silk sheets

Have you ever thought about writing an e-book or guest authoring on other websites? I have a blog based on the same subjects you discuss and would love to have you share some stories/information. I know my visitors would value your work. If you are even remotely interested, feel free to send me an email.

안전놀이터

Wonderful goods from you, man. I’ve understand your stuff previous to and you are just too great. I actually like what you’ve acquired here, really like what you’re saying and the way in which you say it. You make it enjoyable and you still care for to keep it smart. I cant wait to read far more from you. This is really a great web site.

More Help

There may be noticeably a bundle to know about this. I assume you made sure nice points in options also.

discover this

Thanks for your handy post. Over time, I have come to be able to understand that the symptoms of mesothelioma cancer are caused by your build up of fluid regarding the lining of the lung and the chest cavity. The illness may start inside chest vicinity and distribute to other body parts. Other symptoms of pleural mesothelioma include fat loss, severe deep breathing trouble, vomiting, difficulty swallowing, and swelling of the neck and face areas. It ought to be noted that some people with the disease never experience virtually any serious indicators at all.

Floky

The following time I learn a blog, I hope that it doesnt disappoint me as a lot as this one. I mean, I know it was my option to read, however I actually thought youd have something fascinating to say. All I hear is a bunch of whining about something that you can repair when you werent too busy looking for attention.

custom tshirts

You made some clear points there. I looked on the internet for the subject matter and found most individuals will go along with with your website.

Cennik Serwisu Internetowego Gorzow Wielkopolski

I have not checked in here for a while as I thought it was getting boring, but the last several posts are great quality so I guess I’ll add you back to my daily bloglist. You deserve it my friend 🙂

메이저사이트추천

hello there and thank you for your info – I’ve definitely picked up anything new from right here. I did however expertise several technical points using this website, since I experienced to reload the web site a lot of times previous to I could get it to load correctly. I had been wondering if your hosting is OK? Not that I’m complaining, but sluggish loading instances times will sometimes affect your placement in google and could damage your quality score if advertising and marketing with Adwords. Well I’m adding this RSS to my email and can look out for a lot more of your respective exciting content. Make sure you update this again soon..

먹튀폴리스검증업체

Excellent beat ! I would like to apprentice whilst you amend your site, how could i subscribe for a blog site? The account helped me a appropriate deal. I were a little bit acquainted of this your broadcast provided vibrant clear concept

nfl computer power rankings

of course like your web site but you have to check the spelling on several of your posts. Several of them are rife with spelling problems and I find it very troublesome to tell the truth nevertheless I’ll definitely come back again.

KelMoge

Is Cephalexin Safe When Pregnant Kamagra Directions Of Use Zithromax For Acne viagra online pharmacy Le Viagra Doctissimo Real Free Shipping Clobetasol 0.05% Visa Accepted

w88 blog

Dead written content material , thankyou for selective information .

nonton film

Hello there, just became alert to your blog through Google, and found that it’s really informative. I am gonna watch out for brussels. I’ll appreciate if you continue this in future. Numerous people will be benefited from your writing. Cheers!

먹튀폴리스 먹튀

I¡¦ve been exploring for a little bit for any high-quality articles or weblog posts in this kind of space . Exploring in Yahoo I finally stumbled upon this site. Studying this information So i¡¦m glad to express that I have an incredibly excellent uncanny feeling I found out just what I needed. I so much for sure will make sure to don¡¦t forget this web site and provides it a glance regularly.

https://www.pinterest.com/pin/745697650780011933/

I dugg some of you post as I cerebrated they were extremely helpful very helpful

메이저토토사이트

What i don’t understood is actually how you’re not actually much more well-liked than you might be now. You are very intelligent. You realize therefore considerably relating to this subject, made me personally consider it from so many varied angles. Its like men and women aren’t fascinated unless it’s one thing to accomplish with Lady gaga! Your own stuffs excellent. Always maintain it up!

obat kuat

Hello.This article was extremely fascinating, especially since I was searching for thoughts on this matter last couple of days.

Skin Alley

Thank you a lot for providing individuals with an extremely wonderful opportunity to read critical reviews from here. It’s always very sweet and also full of amusement for me and my office friends to search your blog at minimum 3 times weekly to study the newest tips you have got. Not to mention, we are at all times contented concerning the perfect secrets you give. Certain 4 areas on this page are surely the most impressive we’ve had.

Skin Alley

I mastered more new stuff on this weight-loss issue. One issue is that good nutrition is extremely vital any time dieting. A huge reduction in bad foods, sugary food, fried foods, sweet foods, pork, and whitened flour products could possibly be necessary. Retaining wastes bloodsuckers, and contaminants may prevent goals for losing belly fat. While specified drugs in the short term solve the issue, the horrible side effects will not be worth it, and in addition they never present more than a short lived solution. It’s a known indisputable fact that 95% of fad diets fail. Thank you for sharing your notions on this blog site.

manicure

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several e-mails with

the same comment. Is there any way you can remove me from that service?

Thank you!

메이저토토

I gotta bookmark this site it seems very useful very helpful

LG washing machine parts

Whats Going down i’m new to this, I stumbled upon this I’ve found It positively helpful and it has aided me out loads. I hope to contribute & help other customers like its aided me. Good job.

Kinderfotos Vorarlberg

Babyfotografin Dornbirn

แอร์เคลื่อนที่

You made some decent points there. I did a search on the subject and found most guys will approve with your website.

Managed Dedicated

I want to show my appreciation for your kindness supporting persons that absolutely need help on this important theme. Your special commitment to passing the solution up and down turned out to be astonishingly productive and have in every case permitted individuals like me to realize their goals. This invaluable information indicates so much to me and additionally to my colleagues. Warm regards; from everyone of us.

hosting

Hello just wanted to give you a quick heads up. The words in your article seem to be running off the screen in Internet explorer. I’m not sure if this is a format issue or something to do with browser compatibility but I thought I’d post to let you know. The style and design look great though! Hope you get the issue solved soon. Cheers

Silk Wedding Flowers

It’s in point of fact a nice and helpful piece of info. I am satisfied that you simply shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

먹튀 검증

Hello, i think that i saw you visited my site thus i came to “return the favor”.I’m trying to find things to improve my site!I suppose its ok to use a few of your ideas!!

keluaran semua togel

Can I just say what a comfort to discover somebody who really knows what they are discussing on the internet. You certainly realize how to bring a problem to light and make it important. More and more people have to look at this and understand this side of your story. I was surprised you aren’t more popular because you definitely possess the gift.

먹튀폴리스 먹튀

Hi, Neat post. There is an issue with your web site in internet explorer, would test this¡K IE still is the marketplace chief and a good component to other folks will miss your magnificent writing due to this problem.

จัดงานแต่งงาน

Today, taking into consideration the fast life style that everyone is having, credit cards have a big demand throughout the market. Persons from every arena are using the credit card and people who are not using the card have made arrangements to apply for just one. Thanks for revealing your ideas about credit cards.

nutrisystem uniquely yours

Hi, Neat post. There’s a problem with your web site in internet explorer, would test this… IE still is the market leader and a good portion of people will miss your excellent writing because of this problem.

Gay Pride 2019 Rapper

I’m really enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Outstanding work!

먹튀 폴리스

I would like to thank you for the efforts you have put in writing this site. I am hoping the same high-grade site post from you in the upcoming also. Actually your creative writing skills has inspired me to get my own website now. Really the blogging is spreading its wings rapidly. Your write up is a good example of it.

seksiseuraa

I do not even know how I ended up here, but I thought this post

was good. I do not know who you are but definitely you are going to

a famous blogger if you are not already 😉 Cheers!

download w88

Unquestionably believe that which you stated. Your favorite reason seemed to be on the net the easiest thing to be aware of. I say to you, I certainly get annoyed while people consider worries that they plainly do not know about. You managed to hit the nail upon the top and defined out the whole thing without having side-effects , people can take a signal. Will probably be back to get more. Thanks

InventHelp Patent Services

Its such as you read my thoughts! You seem to know a lot about this, like you wrote the e book in it or something. I think that you simply can do with a few percent to power the message house a bit, but instead of that, that is magnificent blog. A fantastic read. I will definitely be back.

งานแต่งงาน

You made a few good points there. I did a search on the topic and found a good number of folks will go along with with your blog.

Ormekur kat

Thanks for discussing your ideas. I would also like to mention that video games have been at any time evolving. Modern technology and inventions have aided create practical and fun games. These kinds of entertainment games were not that sensible when the concept was first being tried out. Just like other areas of technologies, video games also have had to evolve via many generations. This itself is testimony on the fast progression of video games.

m w88

Some genuinely prime blog posts on this website , saved to favorites .

จัดเลี้ยงแบบค็อกเทล

I enjoy the efforts you have put in this, appreciate it for all the great content.

climatiseurs ventilateurs

Some genuinely good blog posts on this website, thanks for contribution. “The spirit is the true self.” by Marcus Tullius Cicero.

precision air conditioning

Wonderful blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Many thanks

รับจัดบุฟเฟ่ต์

I’m still learning from you, while I’m improving myself. I absolutely liked reading all that is posted on your blog.Keep the information coming. I liked it!

Balon Promosi

Good write-up, I am normal visitor of one’s website, maintain up the excellent operate, and It is going to be a regular visitor for a lengthy time.

slot

It’s really a great and helpful piece of information. I’m happy that you just shared this useful information with us. Please stay us up to date like this. Thanks for sharing.

John Deere Technical Manuals

It’s actually a cool and useful piece of info. I am glad that you just shared this useful info with us. Please keep us up to date like this. Thank you for sharing.

4BHK in Triplicane High Road

Hey, you used to write great, but the last several posts have been kinda boring… I miss your tremendous writings. Past few posts are just a bit out of track! come on!

spider-man far from home the movie

What i don’t understood is in fact how you’re no longer really much more well-appreciated than you might be now. You’re very intelligent. You already know thus considerably in the case of this subject, produced me in my view imagine it from a lot of varied angles. Its like women and men aren’t involved unless it is something to accomplish with Woman gaga! Your own stuffs outstanding. At all times handle it up!

iphone x screen replacement

Magnificent items from you, man. I have bear in mind your stuff previous to and you are simply too magnificent. I really like what you have bought right here, really like what you are stating and the best way by which you are saying it. You make it enjoyable and you continue to care for to stay it smart. I can not wait to learn much more from you. This is actually a wonderful web site.

filter air surabaya

Excellent post. I used to be checking continuously this weblog and I’m impressed! Extremely useful information specifically the ultimate section 🙂 I handle such info a lot. I was looking for this particular information for a very long time. Thank you and good luck.

Lestreary

Purchase Tamoxifen Amoxil Clavulanique viagra effet Amoxicillin Ointment Amoxicillin And Ilads

Hochzeit Fotograf Dornbirn

Hochzeit Fotograf Dornbirn

john spencer ellis location free business

My brother recommended I would possibly like this blog. He was entirely right. This post actually made my day. You cann’t imagine simply how so much time I had spent for this information! Thanks!

Cat Toys

Hi, Neat post. There’s an issue with your web site in web explorer, could test this… IE still is the market leader and a good component of other folks will omit your great writing because of this problem.

visit now

Wow, fantastic weblog format! How long have you ever been running a blog for? you made running a blog look easy. The entire glance of your web site is great, let alone the content!

is.gd

You actually make it seem so easy with your presentation but I find this topic to be really something that I think I would never understand.

It seems too complex and extremely wide for me. I am having a look forward on your next publish, I’ll try to

get the cling of it!

hack generator

Thanks for your post. I also think laptop computers are getting to be more and more popular these days, and now are usually the only sort of computer used in a household. It is because at the same time they are becoming more and more very affordable, their processing power is growing to the point where these are as strong as desktop through just a few years ago.

anti-money laundering

Thank you for sharing excellent informations. Your web site is so cool. I’m impressed by the details that you’ve on this web site. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for extra articles. You, my friend, ROCK! I found simply the information I already searched all over the place and simply could not come across. What a perfect web-site.

women in business

Thanks for your write-up on the vacation industry. We would also like to include that if your senior considering traveling, it can be absolutely important to buy travel insurance for older persons. When traveling, elderly people are at high risk being in need of a professional medical emergency. Obtaining the right insurance cover package on your age group can look after your health and provide peace of mind.

Danae

Hey there! I just want to offer you a huge thumbs

up for the excellent info you’ve got right here on this post.

I’ll be coming back to your blog for more soon.

Filmproduktion Wien

Werbefilmproduktion Wien

Agen SV388

Wow, fantastic blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is great, as well as the content!

agen slot casino

Today, taking into consideration the fast chosen lifestyle that everyone leads, credit cards have a huge demand throughout the market. Persons out of every discipline are using credit card and people who aren’t using the card have arranged to apply for one in particular. Thanks for spreading your ideas about credit cards.

seksiseuraa

I have been surfing on-line greater than three hours lately, but I never found any attention-grabbing article like yours.

It is pretty worth sufficient for me. Personally, if all web owners and

bloggers made excellent content material as you probably

did, the net might be a lot more useful than ever before.

KelMoge

Buying Domperidone In Canada Buy 2.5mg Cialis Online online cialis When To Take Viagra Vardenafil Cheap 5 Mg Price Propecia De 5mg

Florian

Hello! I just wanted to ask if you ever have any issues with hackers?

My last blog (wordpress) was hacked and I ended up losing months of hard work due to

no back up. Do you have any solutions to stop hackers?

Cooking oil

This is the right blog for anyone who desires to seek out out about this topic. You understand so much its virtually arduous to argue with you (not that I actually would need…HaHa). You definitely put a brand new spin on a topic thats been written about for years. Great stuff, just great!

sex hebat

I have been reading out a few of your articles and i can claim clever stuff. I will make sure to bookmark your blog.

OTP Token

It is truly a nice and useful piece of info. I am happy that you just shared this useful information with us. Please stay us up to date like this. Thanks for sharing.

voyance rouge suisse

Virtually all of what you point out is supprisingly accurate and that makes me ponder the reason why I had not looked at this in this light before. This particular article really did turn the light on for me personally as far as this issue goes. Nevertheless there is one position I am not too comfortable with so while I attempt to reconcile that with the actual central idea of the position, allow me observe just what all the rest of the readers have to say.Nicely done.

T-eMail

Hello there! Quick question that’s totally off topic. Do you know how to make your site mobile friendly? My site looks weird when browsing from my iphone4. I’m trying to find a theme or plugin that might be able to resolve this problem. If you have any recommendations, please share. Cheers!

W88

Does your website have a contact page? I’m having a tough time locating it but, I’d like to send you an e-mail. I’ve got some ideas for your blog you might be interested in hearing. Either way, great blog and I look forward to seeing it improve over time.

US fake ID

Thanks for the sensible critique. Me & my neighbor were just preparing to do some research about this. We got a grab a book from our local library but I think I learned more from this post. I’m very glad to see such great info being shared freely out there.

Crypto Win

I like this post, enjoyed this one appreciate it for putting up. “What is a thousand years Time is short for one who thinks, endless for one who yearns.” by Alain.

Casino

Woah! I’m really loving the template/theme of this blog. It’s simple, yet effective. A lot of times it’s tough to get that “perfect balance” between superb usability and appearance. I must say that you’ve done a superb job with this. In addition, the blog loads super fast for me on Opera. Superb Blog!

carstyle crew

As soon as I discovered this web site I went on reddit to share some of the love with them.

eargo

I have recently started a site, the info you offer on this web site has helped me tremendously. Thank you for all of your time & work. “The very ink with which history is written is merely fluid prejudice.” by Mark Twain.

baskbetball news

I have acquired some new issues from your internet site about computer systems. Another thing I’ve always assumed is that computer systems have become something that each family must have for several reasons. They offer convenient ways in which to organize households, pay bills, shop, study, focus on music as well as watch tv programs. An innovative method to complete these types of tasks is a notebook computer. These desktops are mobile ones, small, potent and mobile.

yoga neubau 1070

Yoga Neubau 1070

https://www.pinterest.com/pin/745697650780079598/

Hello.This post was extremely motivating, particularly since I was investigating for thoughts on this subject last Monday.

How to earn extra money

My wife and i felt really delighted that Albert managed to deal with his studies out of the ideas he received from your weblog. It’s not at all simplistic to simply possibly be handing out facts which usually a number of people might have been selling. We acknowledge we now have the website owner to appreciate because of that. The type of explanations you have made, the simple website menu, the friendships you can make it easier to foster – it’s got many superb, and it is letting our son in addition to the family reckon that that theme is thrilling, which is particularly important. Thank you for all the pieces!

bitcoin arbitrage

Good website! I truly love how it is simple on my eyes and the data are well written. I am wondering how I might be notified when a new post has been made. I’ve subscribed to your RSS feed which must do the trick! Have a great day!

http://billgatesmicrosoft.com/billhouse.htm/

I’ve recently started a blog, the information you provide on this web site has helped me tremendously. Thank you for all of your time & work.

http://mobile.twitter.com/genesis2mining/

Pretty nice post. I just stumbled upon your weblog and wanted to say that I have really enjoyed surfing around your blog posts. After all I will be subscribing to your rss feed and I hope you write again very soon!

boutique clothing for women

I was very happy to seek out this net-site.I wished to thanks in your time for this wonderful learn!! I positively enjoying every little bit of it and I’ve you bookmarked to check out new stuff you weblog post.

american politics

There is noticeably a bundle to find out about this. I assume you made sure good points in features also.

비아그라

I’m often to running a blog and i really recognize your content. The article has really peaks my interest. I’m going to bookmark your web site and hold checking for brand spanking new information.

ปั้มไลค์

Like!! I blog frequently and I really thank you for your content. The article has truly peaked my interest.

W88

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is important and everything. Nevertheless just imagine if you added some great pictures or videos to give your posts more, “pop”! Your content is excellent but with pics and clips, this website could undeniably be one of the most beneficial in its niche. Wonderful blog!

Bangalore

hello!,I really like your writing very much! proportion we keep up a correspondence extra about your post on AOL? I require a specialist on this house to unravel my problem. Maybe that’s you! Having a look ahead to look you.

Lenore

Great beat ! I would like to apprentice while you amend

your website, how could i subscribe for a blog site? The account aided me

a acceptable deal. I had been tiny bit acquainted of this your broadcast offered

bright clear concept

รับประกันตัวผู้ต้องหา

I think this is among the most significant info for me. And i’m glad reading your article. But should remark on some general things, The site style is wonderful, the articles is really excellent : D. Good job, cheers

비아그라

Thanks for discussing your ideas. I’d personally also like to say that video games have been actually evolving. Modern tools and enhancements have served create reasonable and enjoyable games. These kind of entertainment video games were not really sensible when the actual concept was first being experimented with. Just like other designs of technologies, video games also have had to grow by many many years. This is testimony on the fast progression of video games.

3d

Good day I am so glad I found your weblog, I really found you by error, while I was searching on Digg for something else, Anyways I am here now and would just like to say thanks for a remarkable post and a all round thrilling blog (I also love the theme/design), I don’t have time to read it all at the minute but I have book-marked it and also added your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the fantastic job.

도박사이트

In these days of austerity and also relative anxiety about having debt, a lot of people balk about the idea of having a credit card in order to make purchase of merchandise or maybe pay for a holiday, preferring, instead just to rely on the actual tried and also trusted procedure for making payment – cash. However, if you have the cash on hand to make the purchase in whole, then, paradoxically, that is the best time for them to use the credit cards for several reasons.

Amazon accounts for sale

I truly appreciate this post. I’ve been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again!

cbd vape

Hey very cool blog!! Guy .. Beautiful .. Amazing .. I’ll bookmark your site and take the feeds also…I’m happy to find numerous useful info here within the publish, we’d like work out extra techniques on this regard, thank you for sharing.

Green Card Organization

Hiya very nice web site!! Man .. Beautiful .. Amazing .. I will bookmark your site and take the feeds additionally…I’m satisfied to find so many useful info right here in the submit, we need develop more techniques in this regard, thanks for sharing. . . . . .

w88

I truly appreciate this post. I’ve been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thanks again!

Marketingagentur Nordhorn Homepage

I haven’t checked in here for some time as I thought it was getting boring, but the last several posts are great quality so I guess I’ll add you back to my everyday bloglist. You deserve it my friend 🙂

w88 kasino

It is perfect time to make some plans for the future and it’s time to be happy. I have read this post and if I could I want to suggest you some interesting things or advice. Perhaps you could write next articles referring to this article. I desire to read more things about it!

Lestreary

Cheap Augmentin cialis no prescription Can I Purchase Elocon 0.1% Viagra Prix Pharmacie Forum Baclofene Winthrop 10 Mg

W88

Valuable info. Lucky me I found your site by accident, and I’m shocked why this accident did not happened earlier! I bookmarked it.

unicc

Thank you for sharing excellent informations. Your site is very cool. I’m impressed by the details that you have on this site. It reveals how nicely you understand this subject. Bookmarked this website page, will come back for extra articles. You, my pal, ROCK! I found simply the information I already searched everywhere and just couldn’t come across. What a great website.

discount contact lenses

I genuinely enjoy looking through on this website , it has good posts . “The longing to produce great inspirations didn’t produce anything but more longing.” by Sophie Kerr.

Big Dicks

Very interesting topic, regards for putting up.

Lakseolie bloggen

I really enjoy the blog post.Really thank you!

me suba

5gGouT This very blog is definitely entertaining additionally amusing. I have discovered a lot of helpful tips out of this source. I ad love to visit it every once in a while. Thanks!

W88 Thailand

I have to point out my passion for your kind-heartedness giving support to people that need help with this particular concept. Your very own dedication to passing the message all through was incredibly useful and have continually allowed girls just like me to attain their desired goals. Your personal important report means a lot to me and additionally to my peers. Best wishes; from each one of us.

KelMoge

Kamagra Wo Bestellen Help To Purchase Plavix Cialis Compra cialis vs viagra Cialis 5 Mg Prezzi

w88.com

Would you be interested in exchanging hyperlinks?

w88

Excellent beat ! I wish to apprentice while you amend your site, how could i subscribe for a blog site? The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast provided bright clear concept

w88thai

One more thing. In my opinion that there are quite a few travel insurance web-sites of dependable companies that let you enter your journey details to get you the estimates. You can also purchase the particular international travel cover policy on the net by using the credit card. Everything you need to do is always to enter your current travel specifics and you can begin to see the plans side-by-side. Only find the package that suits your finances and needs after which it use your credit card to buy it. Travel insurance online is a good way to start looking for a reputable company to get international holiday insurance. Thanks for revealing your ideas.

Maryjo Philman

Appreciate the efforts

eebest8 back

“I really liked your blog article.Really looking forward to read more. Keep writing.”

w88

I¡¦ve learn a few excellent stuff here. Definitely price bookmarking for revisiting. I wonder how so much attempt you set to make the sort of great informative website.

mia pron khalifa

i6O9X0 Im thankful for the post.Thanks Again. Want more.

W88 là gì

I haven’t checked in here for a while because I thought it was getting boring, but the last few posts are great quality so I guess I’ll add you back to my daily bloglist. You deserve it my friend 🙂

เช่าเก้าอี้

This website is mostly a walk-by means of for the entire data you wished about this and didn’t know who to ask. Glimpse right here, and you’ll positively uncover it.

get coupon

Hey, you used to write wonderful, but the last several posts have been kinda boring… I miss your super writings. Past several posts are just a little out of track! come on!

แต่งงาน สยามสมาคม

Very interesting information!Perfect just what I was searching for!

W88 Thai

Rattling nice style and excellent content , practically nothing else we need : D.

round the world flights

Wow, wonderful blog structure! How lengthy have you been running a blog for? you made running a blog glance easy. The overall look of your site is magnificent, let alone the content!

ห้องจัดเลี้ยง thai cc

Throughout the grand pattern of things you’ll receive a B- for effort. Where exactly you confused me ended up being on all the details. As people say, details make or break the argument.. And that could not be more true here. Having said that, allow me say to you just what did deliver the results. Your writing is definitely quite powerful which is most likely the reason why I am taking the effort to opine. I do not make it a regular habit of doing that. Next, while I can certainly see the leaps in reason you make, I am not necessarily certain of how you seem to unite your ideas which in turn produce your conclusion. For the moment I will subscribe to your position but wish in the future you connect the dots better.

งานแต่งงาน

My spouse and i have been very relieved Chris could finish off his inquiry from your ideas he got from your web pages. It’s not at all simplistic to simply happen to be making a gift of hints which some other people may have been making money from. And we keep in mind we have got the website owner to be grateful to because of that. These illustrations you have made, the straightforward site navigation, the relationships you will help engender – it’s many terrific, and it’s making our son in addition to us recognize that the matter is amusing, and that is incredibly essential. Thanks for the whole lot!

Top Down Bottom Up Shades Pictures

Hello.This post was extremely fascinating, especially since I was browsing for thoughts on this topic last Saturday.

Demetria Rom

Im grateful for the blog article. Awesome.

Kamagra priser i Sverige

You have made some decent points there. I looked on the internet for more information about the issue and found most individuals will go along with your views on this site.

univerzitet

It as enormous that you are getting ideas from this piece of writing as well as from our dialogue made at this place.

W88 Thai

I absolutely love your blog and find most of your post’s to be what precisely I’m looking for. Would you offer guest writers to write content for you? I wouldn’t mind publishing a post or elaborating on most of the subjects you write regarding here. Again, awesome website!

find out more

Thank you for your blog post.Thanks Again. Will read on

Dani Daniels

This blog site is pretty cool. How can I make one like this ? How To Donate A Car For Tax Deduction

formuler z8