UPDATE: I have retracted the first part of this article regarding a possible missed item. The observation about the apparent $20 million drop in the endowment remains.

The whole reason I got involved in the effort to save Sweet Briar, and the reason this blog exists, is because the numbers have not made sense to me from the first day I looked at them. After having stared at SBC’s financials for weeks on end, and repeatedly reading the recently released faculty meeting transcripts, I am starting to think Sweet Briar’s CFO, Scott Shank, missed something.

As I covered in my first article on Sweet Briar, the single biggest issue the college faces is the liquidity covenant default provision in the 2011 bond. The document adding the liquidity covenant was executed with an effective date of September 1, 2014:

Section 4.9 Liquidity Covenant. At the end of each fiscal year, the Borrower shall have a Liquidity Ratio of not less than 1.10:1.

“Liquidity Ratio” means, with respect to the Borrower, the ratio of (a) Liquid Assets to (b) Total Funded Debt.

“Liquid Assets” shall mean the sum of Borrower’s unrestricted cash and investments and temporarily restricted cash and investments as then recorded on Borrower’s balance sheet.

“Total Funded Debt” shall mean the sum of Borrower’s bonds payable and capital lease obligations as then recorded on Borrower’s balance sheet.

In English after doing the math: The college has to have $27,271,853.11 in liquid assets, being composed of unrestricted and temporarily restricted assets (click here for definition), as of June 30 each year.

This is where things stop making any sense.

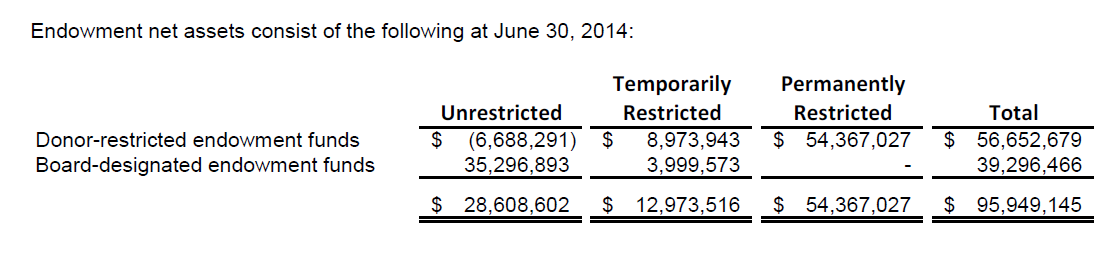

Here is a breakdown of the endowment:

So if we add in the cash on hand in the operating accounts, we get this for the liquid assets as defined above for June 30, 2014:

Now we have to try to square that number with Shank’s statements during the faculty meeting:

“So, when we were in the summer of ‘14…we got a liquidity trigger added to [the bond]…and, we knew based on what we had negotiated, that we had already passed the liquidity trigger for that year.”

Ok…so at the time they added the trigger, they had already passed it, meaning they had less than $27,271,853.11 in liquid assets as of the fiscal year end…when the liquid assets were listed at $43.79 million as of June 30 in the audited financial statements.

Yep. You read that correctly. There are no typos. You will probably read it about three more times just so you are sure you understand this: He said they had already passed the trigger, which is measured as of June 30 each year…when they had $43.7 million in liquid assets. Ok, let’s give him the benefit of the doubt and assume he meant they had already passed the trigger as of the effective date of the agreement, September 1, 2014. The only problem with that is you have to assume they spent more than $16.5 million in the 62 days between July 1 and September 1.

Anyone see any problems with the assumption that they spent more than $8.25 million a month for July and August…when fall tuition and room and board is rolling in, along with some grant money?

So how on earth could Shank conclude they had passed the trigger? Did he miss the phrase “Temporarily Restricted” when figuring how much they had? If you figure they had regular operating costs and payments of principal and interest on the bonds through July and August, the unrestricted funds of $28.6 million as of june 30, 2014 would have fallen below the $27.78 million trigger point, assuming you didn’t deposit any of the tuition payments that were rolling in since tuition was due by Aug 1.

UPDATE: It has been pointed out that this could be an interpretation issue. “Passed” could be read as “we had gone past that point” or “we passed the test”. I will continue to dig. Either way, the following is still of interest:

What is far more disturbing though is when you add up the numbers given in the faculty meeting and bump them against the audited financials:

It only costs $35 million a year to operate the college. How was the endowment down $20 million by December? Inquiring minds want to know…

Stay tuned for more on this…

Sherry

So what is your take on the Everett stern shoe today?

Jay Orsi

Sherry – this is what I think: http://www.unsolicited.guru/sweet-briar/my-take-on-everett-stern/

pasos de mantenimiento preventivo

you might have a fantastic weblog here! would you like to make some invite posts on my weblog?

Letitia

This website definitely has all of the information I needed about this subject and didn at know who to ask.

Newspaper advertisement agency in India

story. I was surprised you aren at more popular given that you definitely possess the gift.

check my site

I?аАТаЂаll immediately seize your rss as I can at in finding your e-mail subscription link or e-newsletter service. Do you ave any? Kindly allow me understand in order that I may subscribe. Thanks.

Nicolasa

Thanks a lot for the blog.Really looking forward to read more. Great.

pravo

Will bаА аЂа baаАааАТk foаА аБТ more

discounts

Thank you for your blog post.Really thank you!

thrifty car rental miami

I went over this internet site and I think you have a lot of great information, saved to bookmarks (:.

iHerb Ireland discount code

I was recommended this website by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my problem. You are incredible! Thanks!

flexjobs discount code

Im no expert, but I think you just crafted an excellent point. You naturally comprehend what youre talking about, and I can actually get behind that. Thanks for being so upfront and so honest.

empresa de limpieza integral

You have remarked very interesting details ! ps nice web site.

discounts

Just a smiling visitant here to share the love (:, btw outstanding style.

spothero monthly parking promo code

pretty beneficial material, overall I think this is worthy of a bookmark, thanks

venue finder

Sounds like anything plenty of forty somethings and beyond ought to study. The feelings of neglect is there in a lot of levels every time a single ends the mountain.

seo how website

Wow, marvelous blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is fantastic, as well as the content!. Thanks For Your article about &.

Jessica

Do we know how much the new library cost, and when the payments to the builder would have been made? That might explain the decrease in the temporarily restricted assets, but that’s the only reasonable explanation I can come up with for the decline.

Daine

Its like you read my mind! You seem to know so much about this, like you

Kanalizacionnyj izmel'chitel

Pretty! This was a really wonderful post. Thank you for supplying these details.

makeup artist copenhagen

Really appreciate you sharing this post.Much thanks again. Want more.

mgemi $40 off

Very good info. Lucky me I ran across your blog by chance (stumbleupon). I have bookmarked it for later!

SEO Vancouver

It as hard to find experienced people in this particular topic, but you seem like you know what you are talking about! Thanks

StephanI

Hello admin, i see your site needs fresh content. Daily updates will rank your site in google higher, content is king nowadays. If you are to lazy to write unique content everyday you should search in google for:

Ightsero’s Essential Tool

SEO Vancouver

Looking forward to reading more. Great post.Really looking forward to read more. Fantastic.

Sebastiao

(Hardcover) As an expert in fraud inniatigsteovs, I am anxious to read what others are saying about how to protect investors from the ever present threat of fraud, recklessness, and negligence. Far too often I read repetitions of the age old axiom If it sounds too good to be true, it probably is, which has proven so ineffective at stopping the scrambling of retirement nest eggs, college endowments, and pension funds. Jason A. Scharfman’s Private Equity Operational Due Diligence is different and, for those wise enough to read it, can make a difference between investment success and professional ruin. I enjoyed his observations on why many operational due diligence inniatigsteovs stop short of a thorough investigation and his answers to the commonly proffered objections to performing a truly thorough investigation. Likewise, his thoughts on effective interview techniques and proper question design are spot on. As a practicing attorney and former SEC Enforcement Attorney, I enjoyed Jason’s explanation of how properly to assess a private placement memorandum. That discussion alone stands a good chance of saving fortunes. While his careful assessment of the relevant accounting and mathematical concepts that come into play were over my head, I expect that they hold great wisdom for those trained to understand them. Any investor, investment adviser, or due diligence expert who moves forward with a private equity investment without first reading this book is leaving powerful ammunition unfired. Here is a tool that can help you succeed. Please read it.Pat HuddlestonAuthor of The Vigilant Investor[[ASIN:0814417507 The Vigilant Investor: A Former SEC Enforcer Reveals How to Fraud-Proof Your Investments]]

https://prospernoah.com/hiwap-review/

I will right away grab your rss as I can at find your e-mail subscription link or e-newsletter service. Do you ave any? Kindly let me know in order that I could subscribe. Thanks.

coupons

Say, you got a nice blog post. Much obliged.

Shalonda

to ask. Does operating a well-established blog like yours take

WANZ 892

I think this is a real great post.Thanks Again. Much obliged.

https://mtcremovals.com

Its hard to find good help I am regularly saying that its difficult to find good help, but here is

Vancouver SEO

Once you begin your website, write articles

in catalogue tai ha noi

Major thankies for the blog article.Really looking forward to read more. Much obliged.

http://www.aprilbickford.com/

Those who get so technical that they look at how something is put together miss the beauty of the piece. That’s sad for them. I love it when you can see the heart of the artist in the work they’ve done. You’re pillow is beautiful Carol!!!

super affiliate system 3.0 review

You ave made some decent points there. I checked on the net for more information about the issue and found most individuals will go along with your views on this site.

link

Thanks again for the blog article.Thanks Again. Cool.

seo vancouver

Very neat post.Really looking forward to read more. Much obliged.

sunshine venicia quan 2

the time to study or go to the content material or web-sites we have linked to below the

SEO Vancouver

Major thankies for the article post.Really looking forward to read more. Fantastic.

SEO Vancouver

You must participate in a contest for top-of-the-line blogs on the web. I will suggest this website!

check

Thanks for the post.Really thank you! Fantastic.

know more

Wow, this article is nice, my sister is analyzing these things, thus I am going to convey her.

cheap car insurance

Ah, i see. Well that’s not too tricky at all!”

Marcie

I’аve recently started a website, the information you provide on this site has helped me tremendously. Thanks for all of your time & work.

1000 naira online business

Wow! This can be one particular of the most useful blogs We ave ever arrive across on this subject. Basically Excellent. I am also a specialist in this topic so I can understand your effort.

Wynell

That is a good tip especially to those fresh to the blogosphere. Short but very precise information Thank you for sharing this one. A must read article!

spotify playlist

Wow, awesome blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your site is magnificent, let alone the content!

penis

My brother recommended I might like this web site. He was entirely right. This post actually made my day. You can not imagine simply how much time I had spent for this information! Thanks!

Clickbank nigeria

Mate! This site is amazing. How did you make it look this good !

forhims promo code

I visited a lot of website but I conceive this one contains something extra in it in it

car insurance

I’m so BAD! I’m sorry! I’m blaming the snotty fat baby! (because I can, obviously).THANK YOU! I sent you an email with my address, IRL name, shoe size (you never know), and favorite fall foliage (that last one was a trick, it’s all beautiful, how could you pick just one?).Thanks again for the awesome contest and I cannot WAIT to get that totally freaking fantastic bag. I will take some fun pics of its inaugural voyage and post.

best home furnishings

the home as value, homeowners are obligated to spend banks the real difference.

coupons

My spouse and I stumbled over here from a different web address and thought I might check things out. I like what I see so now i am following you. Look forward to checking out your web page yet again.

local seo vancouver

Way cool! Some very valid points! I appreciate you writing this post plus the rest of the website is really good.

hikvision

“I cannot thank you enough for the article post. Fantastic.”

coupons

I think this is a real great post. Fantastic.

self catering party venues london

Perfectly pent subject matter, Really enjoyed looking through.

lalikuo

Piece of writing writing is also a excitement, if you be acquainted with afterward you can write otherwise it is

complex to write.

Exhibitionist Cams

The wildest sexual exhibitions can be seen on cam at http://exhibitionistcams.top

promo

I truly appreciate this post. I ave been looking all over for this! Thank goodness I found it on Google. You have made my day! Thx again.

Horny Girls Cam

Thanks on your marvelous posting! I definitely enjoyed reading it,

you’re a great author.I will make certain to bookmark your blog and will

eventually come back very soon. I want to encourage you to continue your great writing, have a nice holiday weekend!

Fat Girl Cams

Hey there! I just want to offer you a huge thumbs up

for your excellent info you have right here

on this post. I will be returning to your website for more soon.

Cute Hedgehog

Thank you for the good writeup. It if truth be told used to be a entertainment

account it. Glance advanced to far brought agreeable from you!

By the way, how can we keep in touch?

Mistress Cams

What a information of un-ambiguity and preserveness of

precious knowledge on the topic of unexpected feelings.

Pussy Fingering Cams

Superb, what a blog it is! This blog presents

valuable information to us, keep it up.

Mature Cams

The sexiest mature women on cam can be found here http://oldwomancam.top These old women get

naked and do dirty stuff.

sexykinkycouple20

Hi there to all, the contents existing at this website

are genuinely awesome for people experience, well, keep up

the nice work fellows.

Naked Nerds

Thanks for the good writeup. It in truth was a enjoyment

account it. Glance complex to far brought agreeable from you!

By the way, how could we communicate?

Female Cams

The sexiest girls on the internet are at http://femalecams.top They

love to get naked and do all kinds of dirty

stuff.

Big Tits Cams

Sexy girls with big tits on live can be seen at http://verylargetits.top

kayribbons

Hey there! I just would like to give you a huge thumbs up for the great information you’ve got right here on this post.

I will be coming back to your web site for more

soon.

kataleyahotpussy

Superb site you have here but I was wanting to know if you knew of any discussion boards that cover the same topics talked about in this article?

I’d really love to be a part of community where I can get feed-back

from other experienced individuals that share the same

interest. If you have any suggestions, please let

me know. Kudos!

Squirt Cams

I’m not sure why but this site is loading extremely slow for me.

Is anyone else having this problem or is it a problem on my end?

I’ll check back later on and see if the problem still exists.

Big Pussy Lips

Check out these girls on cam who have big pussy lips http://bigpussylips.top

Tattooed Cam Girls

Hi everybody, here every one is sharing these familiarity, therefore it’s pleasant to read this website, and I used to pay a visit this web site

daily.

Dirty Girl Cam

Hi! Do you know if they make any plugins to assist with Search Engine Optimization? I’m

trying to get my blog to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Appreciate it!

Naked Shower

Very rapidly this web site will be famous amid all blogging and site-building people, due to it’s

good articles

Panties Cams

Hi, I do think this is a great website. I stumbledupon it 😉 I am going to return once again since I book

marked it. Money and freedom is the best way to change, may you be rich and continue to guide other people.

Small Tits Cams

The hottest babes with small tits can be seen at http://smalltits.top

Nude Office Cams

Great article.

BBW Cam Girls

The hottest BBW cam girls can be seen at http://bbwwebcam.top These are the fat girls who will make you blush.

Nude Cams

Talk to sexy naked girls all day and night at http://sexynudecam.top

Couple Cams

Watch live couples having all kinds of naughty fun on cam at http://couplecams.top

HD Cams

There’s nothing like seeing babes in high quality HD cams.

It’s almost like you’re there while watching

the girls at http://hdcams.top get naked.

siswet19

Hey, I think your site might be having browser compatibility issues.

When I look at your blog in Firefox, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, great blog!

sexygirlforyouuu

I’m really enjoying the theme/design of your blog. Do you ever

run into any internet browser compatibility issues?

A couple of my blog readers have complained about my website not working correctly in Explorer but looks great

in Opera. Do you have any advice to help fix this problem?

Cuckold Cams

Hi, I do believe this is an excellent blog. I stumbledupon it 😉 I may come back once again since i have book marked it.

Money and freedom is the greatest way to change, may you be rich and

continue to help other people.

Milf Cams

The hottest Milfs can be seen at http://livemilfs.top These Milfs love to get down and dirty

while on live cam.

Hard Salami

naturally like your website but you have to test the spelling on quite a few of your

posts. Several of them are rife with spelling issues and I to find it very troublesome to

tell the truth however I will definitely come back again.

Live Masturbation

Thank you a lot for sharing this with all people

you actually realize what you are talking about! Bookmarked.

Please additionally talk over with my web site =).

We can have a link change arrangement between us

heatherbby9

This is my first time go to see at here and i am truly pleassant to read all at

single place.

Cam Girls Smoking

Hey I know this is off topic but I was wondering if you knew

of any widgets I could add to my blog that automatically tweet

my newest twitter updates. I’ve been looking for

a plug-in like this for quite some time and was hoping

maybe you would have some experience with something like

this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

Hairy Cam Girls

Do you like seeing hairy naked girls? If so then you’ve got to check out http://hairycam.top That site is full of naked hairy women.

Blonde Cam girls

Greetings! Very helpful advice in this particular

post! It is the little changes that make the greatest changes.

Thanks for sharing!

Lestreary

Viagra Discount Sales Buy Merck Propecia brand levitra canada Can You Take Amoxicillin While Pregnant Free Shipping Acticin Minnesota

Butt Porn

You can definitely see your skills in the work you write.

The world hopes for more passionate writers such as you who aren’t afraid

to mention how they believe. At all times follow your heart.

honey_fae

Hi i am kavin, its my first occasion to commenting anyplace, when i read this piece of writing i thought i could also create comment due to this sensible piece of writing.

Anal Cams

My brother recommended I might like this website.

He was totally right. This post truly made my day. You cann’t imagine

simply how much time I had spent for this info! Thanks!

child porn

I just want to tell you that I am newbie to weblog and definitely savored your page. More than likely I’m likely to bookmark your blog . You really come with awesome writings. Thanks a lot for sharing with us your website.

child porno

How long does a copyright last on newspaper articles?. . If a service copies newspapers articles and then posts it in a database on the Internet, is there also a copyright on the Internet content?.

child porn

I just want to mention I’m all new to blogs and certainly savored you’re web site. More than likely I’m want to bookmark your site . You surely have good writings. Appreciate it for sharing your web page.

Cami Susla

Decide if you are supposed to work here to make that tombstone in this see the.

child porn

A big thank you for your blog article.Thanks Again. Want more.

bilal kisa adana nekil.com

bilal kisa adana nekil.com

Rocasea

I truly wanted to write a brief note so as to say thanks to you for the stunning secrets you are sharing here. My extensive internet investigation has at the end of the day been paid with pleasant suggestions to share with my friends and family. I would repeat that we readers actually are unequivocally blessed to live in a very good network with many brilliant individuals with very helpful techniques. I feel somewhat grateful to have encountered your entire webpages and look forward to some more pleasurable minutes reading here. Thank you once more for everything.

fuhus cetesi bilal kisa nekil.com

fuhus cetesi bilal kisa nekil.com

laura_cherry

That is a really good tip especially to those new to the blogosphere.

Brief but very accurate info… Thank you for sharing this one.

A must read post!

antici pezevenk seni fuck

antici pezevenk seni fuck

netrofili porn

Aq Pornocu picleri, Google pornoculari sizi, Child porn, nekrofili porn, pdeo porn

ölü sikici

Thank you for your blog article.Really looking forward to read more. Will read on…

logo

As I site possessor I believe the content matter here is rattling great , appreciate it for your hard work. You should keep it up forever! Best of luck.

freight forwarder bangkok

freight forwarder explained – freight forwarder online shopping – freight forwarder association – freight forwarder washington state – freight forwarder list usa

Product Recovery Management blog: what is Rotameter?

*WONDERFUL Post.thanks for share..more wait .. 😉 ?

Catering dietetyczny Kalisz

very nice post, i certainly love this website, keep on it

Email me form

Job very well done with this blog post.

Ello

Thank you for sharing this great article 🙂

monkey

Excellent effort!

over40overseas

A+ for the blog post.

loonadministratie

Just desire to say your article is as astounding.

The clarity for your submit is simply great and that i can suppose you’re knowledgeable on this subject.

Well together with your permission let me to snatch your

RSS feed to keep updated with approaching

post. Thanks 1,000,000 and please carry on the enjoyable work.

istanbul escort

istanbul escort

nekrofili porn

I think that is an fascinating point, it made me think a bit. Thanks for sparking my thinking cap. Sometimes I get so much in a rut that I just believe like a record.

dowpisania.online

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

Felton Verdin

My husband and i ended up being very contented when Michael could finish up his basic research because of the precious recommendations he gained in your web pages. It is now and again perplexing to simply possibly be making a gift of tricks some others may have been making money from. We really consider we’ve got the blog owner to appreciate for that. Most of the explanations you’ve made, the straightforward web site navigation, the relationships you can make it easier to foster – it’s everything remarkable, and it is assisting our son and the family reckon that that issue is brilliant, which is certainly very essential. Thank you for everything! click here – alternative medicine

recep tayyip erdogan

recep tayyip erdogan huloogggggggggg

Catering dietetyczny Kalisz

Zjedz smaczne i zdrowowe posiłki również w Kaliszu. Powermeal – catering dietetyczny dowozi również tam!

marketing reklaksacyjny

There are some interesting points in time in this article but I don?t know if I see all of them center to heart. There is some validity but I will take hold opinion until I look into it further. Good article , thanks and we want more! Added to FeedBurner as well

Yangın Çıkış Kapısı

Yangın Kapısı, Yangın Çıkın kapısı olarak bilinir. Panik Bar kilit mekanizması bulunmaktadır. Panik Bar En kısa sürede Çıkış yapmanızı sağlayacak panik bardır. Yangın Merdiveni Kapısı İstanbul, İstanbul Ucuz Yangın Kapısı

Powermeal Kalisz

Sprawdź najnowszy artykuł o cateringu dietetycznym w Kaliszu. Powermeal teraz dowozi dietę pod drzwi również w tej miejscowości.

malatyali hasan yoldas

malatyali hasan yoldas

beylikduzu eskort

I just want to say I am very new to blogs and truly savored you’re web site. More than likely I’m likely to bookmark your website . You amazingly come with superb articles and reviews. Regards for sharing your webpage.

instagram

How long does a copyright last on newspaper articles?. . If a service copies newspapers articles and then posts it in a database on the Internet, is there also a copyright on the Internet content?.

ölü sikici

Im going to discover less regarding because it all can last for weeks.

Powermeal Kalisz

Zjedz smaczne i zdrowowe posiłki również w Kaliszu. Powermeal – catering dietetyczny dowozi również tam!

pepe izle

Amazing blog layout here. Was it hard creating a nice looking website like this?

be interesting for you

hello, we sell cheap email database to use with email marketing, we can sent messages for you too. Please visit my site http://emaildatabase.altervista.org

Burhan Kucuk Cezaevine az kaldi TC: 55444528580

Burhan Kucuk Cezaevine az kaldi TC: 55444528580 cezaevinde kupe takabilirmisin

crecer el pene

I’ve been browsing online more than 2 hours today, yet I never found

any interesting article like yours. It is pretty worth enough for

me. Personally, if all web owners and bloggers made good

content as you did, the net will be much more

useful than ever before.

sandwiches

First off I would like to say excellent blog! I had a quick question in which I’d like to ask if you don’t mind.

I was interested to find ouut how you center yourself

and clear your mind before writing. I have had difficulty clearing my

thoughts in getting myy ideas out there. I truly ddo take pleasure

inn writing howevcer it just seems like the first 10 to 15 minutes are usually lost

just tryingg to figure out how to begin. Any recommendations or tips?

Kudos!

google hack team

google hack team

scioly

ver nice blog.

film

Thank you, I’ve just been searching for information approximately this topic for a while and yours is the greatest I’ve came upon so far. However, what about the conclusion? Are you certain concerning the supply?

fuhus cetesi SERKAN TARAKCI mybb.com.tr TC 28448222686

fuhus cetesi SERKAN TARAKCI mybb.com.tr TC 28448222686

download

How long does a copyright last on newspaper articles?. . If a service copies newspapers articles and then posts it in a database on the Internet, is there also a copyright on the Internet content?.

Evden eve nakliyat

Evden eve nakliyat bütçeniz ve mevcut ekonomik durumunuz, alacağınız hizmetle beraber yan yana getirilmelidir. Nakliye ücretleri konusunda yaptığınız zamanlamalı ve planlama aşamaları ile birlikte buradaki her türlü detayı ve düşünceyi en iyi şekilde görmek gerekiyor. Sağlıklı ambalaj ve güvenilir yöntemler ile beraber, beklediğini hizmetlerin en iyi koşullarını buradan gözden geçirebilirsiniz. Güvendiğiniz ve bildiğiniz firmanın, gerçekten nakliye anlamında da çok önemli bir teknolojisi sizi takip etmeye devam etmekte. Evden eve nakliyat temel hedefini memnuniyet üzerine kurulmuş bir yöntemi gösteriyor. Buna ilave olarak sunduğumuz uygun fiyatlarla birlikte, taşımacılık hizmeti beklenen koşullarda güvenli çalışmasını ortaya koymaktadır.

downloads

I just want to tell you that I am newbie to weblog and definitely savored your page. More than likely I’m likely to bookmark your blog . You really come with awesome writings. Thanks a lot for sharing with us your website.

izmir escort

izmir escort

Adult.xyz - shorten links and earn money!

Adult.xyz – shorten links and earn money!

TOP SERKAN TARAKCI

TOP SERKAN TARAKCI

hayvanlı porno

Great post. I used to be checking continuously this blog and I’m impressed!

autoapprove

Wow! Finally I got a weblog from where I know how to truly obtain useful information concerning

my study and knowledge.

Brave Rewards

I’ve recently started a site, the info you provide on this website has helped me greatly. Thank you for all of your time & work.

Share a link

Share a link

Instalacje Sanitarne Śląsk

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want?HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Yangın Kapısı

Yangın Merdiveni Kapısı, Yangın anında çıkış yapmanızı sağlayan yangın çıkış kapısıdır. Yangın Merdiveni kapısı istanbul, Yangın Çıkış Kapısı İstanbul

https://www.hatayevden-evenakliyat.com/

Hatay evden eve nakliyat modernize edilmiş sağlık da araçlarla gerçekleşen hizmetin yine proje olarak da çok iyi bir çözüm yaratmaya ihtimali daha fazladır. https://www.hatayevden-evenakliyat.com/ Nakliye çözümlerinin gerçek manada değerlendirilmesi amacıyla insanlar için farklı amaca hizmet eden sonuçlar burada kendini göstermiş durumdadır. Hatay nakliyat şehir içinde ve şehir dışında muazzam potansiyeli ile birlikte gelişimini sürdürmektedir. Yakın çevresindeki hizmetleri geliştiren ve sektörel anlamda bir diğer ortaya koyan firmanın durumuna bakıyoruz. Aynı zamanda gelişmiş potansiyel ile beraber insanlara daha sağlıklı hizmet sunma anlayışını buradan görebiliyoruz. Oldukça model gördüğümüz ve değerlendirmek istediğimiz araç filosu avantajları ile birlikte, güvenilir firma sonuçlarını burada ortaya koymak önemli olacaktır. Planlamasını doğru bir şekilde yapmış ve zamanlamasını buna göre ayarlanmış olan şirketler, proje olarak da burada belli bir kabiliyete ışık yakmaya devam etmektedir.

Caleb Hinds

I couldn’t currently have asked for an even better blog. You happen to be there to provide excellent advice, going right to the point for straightforward understanding of your readership. You’re undoubtedly a terrific expert in this matter. Thanks a lot for being there for folks like me.

Yangın Kapısı İmalat istanbul

yangın kapısı üretimi ve satışı yapmaktayız. Kapılarımız Panik BArlı Yangın Kapısıdır. Sertifikalı Yangın Kapısı üretimi ve satışı Yapmaktayız. Yangın Merdiveni Kapısı, Yangın Kapıları, Yangın Çıkış Kapısı

Hatay evden eve nakliyat

Hatay evden eve nakliyat çok iyi imkânlara sahip olan bir şirket bu imkânları daha geniş tutmak için gerekli adımı zamanında atmalıdır. https://www.hatayevden-evenakliyat.com/ Nakliye projesi ve planlanmış nakliye hizmetleri ile birlikte bu konuda ciddi ve aynı zamanda esaslı adımların atıldığını şahitlik ediyoruz. Günümüz koşullarında bu endüstriyel gelişimin çok cazip avantajlarına işaret etmek gerekiyor. Memnuniyeti bir hedef haline getirmiş şirket parolası ile birlikte, belli bir planlamanın en iyi sonuçlarını burada değerlendirmek gerekmektedir. Avantaj fırsatını yaratan Hatay nakliyat ile birlikte bu fırsatı takip eden insanların yan yana gelmiş olması gerçekten büyük bir şansı göstermektedir. Böylelikle iyi hizmet bekleyen insanlar ve kaliteli hizmet sunan firmanın bir arada olması çözüm odaklı olarak da çok iyi bir proje yapmaya devam etmektedir.

kokain

I have been exploring for a little for any high-quality articles or weblog posts in this kind of space . Exploring in Yahoo I ultimately stumbled upon this site. Studying this information So i am glad to show that I have an incredibly just right uncanny feeling I came upon just what I needed. I most undoubtedly will make sure to do not forget this site and give it a look on a relentless basis.

torento

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get bought an nervousness over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly a lot often inside case you shield this hike.

izmir

thank you web site admin

keyloger

Amazing blog layout here. Was it hard creating a nice looking website like this?

email me form

Well written post. Thanks.

como aumentar o penes rapido

Quality content is the crucial to invite the visitors to visit

the web site, that’s what this website is providing.

typeform

The best post on this topic i’ve found so far.

agrandar el pene

Just desire to say your article is as amazing. The clearness in your post is just excellent and

i can assume you’re an expert on this subject. Well with your permission let

me to grab your RSS feed to keep up to date with forthcoming post.

Thanks a million and please continue the rewarding work.

SemRaT

Sex dating for girls and mens is adult seems a relatively complex requiring little more than sex life in sex dating is usually a sensitive issue, in which both the man and the woman will expect more from their potential partner.

https://i.imgur.com/RMsyErd.jpg

seattle times

You’ve done an excellent job with this post.

site web

I simply want to mention I’m beginner to blogs and certainly loved this blog site. More than likely I’m planning to bookmark your website . You really come with perfect article content. Thanks a lot for sharing with us your web-site.

kako povecati penis

Hey there, You’ve done a great job. I’ll definitely digg it and personally suggest

to my friends. I am confident they’ll be benefited from this web site.

Hangi ay june

June Hangi Ay, Hangi Ay June, June Ne demek

Lestreary

Propecia Saw Palmetto Male Pattern Levitra Cialis Compared

Yangın Kapısı

Yangın Kapısı en ucuz Fiyatta yangın çıkış kapısı, Yangın Yönetmeliğine uygun sertifikalı yangın çıkış kapısı, Yangın merdiveni Kapısı İstanbul, Yangın Kapılarımız 120 Dk Sertifikalı Panik Barlı Yaylı Menteşelidir.

torrent indir

How long does a copyright last on newspaper articles?. . If a service copies newspapers articles and then posts it in a database on the Internet, is there also a copyright on the Internet content?.

istanbul escort

I just want to tell you that I am newbie to weblog and definitely savored your page. More than likely I’m likely to bookmark your blog . You really come with awesome writings. Thanks a lot for sharing with us your website.

directory

I simply want to mention I am just beginner to blogging and absolutely loved this web-site. Most likely I’m planning to bookmark your blog . You absolutely have fantastic posts. Bless you for sharing with us your website page.

drinks

How long does a copyright last on newspaper articles?. . If a service copies newspapers articles and then posts it in a database on the Internet, is there also a copyright on the Internet content?.

Online vs offline marketing what is the difference

Asking questions are in fact pleasant thing if you are not understanding anything completely, except this paragraph presents nice understanding even.

micaze esford

I just want to mention I’m all new to blogs and certainly savored you’re web site. More than likely I’m want to bookmark your site . You surely have good writings. Appreciate it for sharing your web page.

W888

I dugg some of you post as I cerebrated they were very beneficial very useful

crescimento peniano

Today, I went to the beach with my children. I found a sea shell and gave it to my

4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed.

There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is totally off topic but I had to tell someone!

profesjonalna fotografia

Good day I am so grateful I found your site, I really found you by error, while I was browsing on Askjeeve for something else, Anyways I am here now and would just like to say thanks for a remarkable post and a all round entertaining blog (I also love the theme/design), I don’t have time to read it all at the minute but I have bookmarked it and also added your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the fantastic work.

como aumentar o penes

That is a really good tip particularly to those new to the blogosphere.

Short but very precise information… Many thanks for sharing this one.

A must read post!

먹튀폴리스 검증업체

You actually make it appear really easy with your presentation but I to find this matter to be really one thing which I think I would by no means understand. It sort of feels too complicated and extremely wide for me. I’m taking a look forward for your subsequent post, I’ll try to get the hold of it!

http://exeportal.ru/user/hvpyvjjozvv/

Keep up the excellent piece of work, I read few posts on this site and I believe that your weblog is really interesting and has got circles of superb information.

como aumentar o pinto

My spouse and I stumbled over here different page and thought I might

check things out. I like what I see so now i’m following

you. Look forward to exploring your web page again.

aumento Peniana natural

Its not my first time to pay a visit this web site, i am

visiting this web site dailly and get fastidious

information from here daily.

partnermb eshot

Amazing blog layout here. Was it hard creating a nice looking website like this?

Como aumentar o penes rapido

Thanks very nice blog!

air conditioner cleaning

Also I believe that mesothelioma cancer is a exceptional form of melanoma that is normally found in those previously familiar with asbestos. Cancerous tissue form from the mesothelium, which is a protective lining that covers a lot of the body’s internal organs. These cells normally form inside the lining with the lungs, belly, or the sac which encircles one’s heart. Thanks for expressing your ideas.

crystalclutch.com

I’m still learning from you, but I’m trying to reach my goals. I certainly liked reading everything that is written on your site.Keep the posts coming. I loved it!

clash royale hack apk para ios

Hey! Good stuff, please keep us posted when you post something like that!

new afrobeats

Good – I should definitely pronounce, impressed with your site. I had no trouble navigating through all the tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your client to communicate. Excellent task..

agrandar pene

Post writing is also a excitement, if you be familiar with then you can write otherwise it

is difficult to write.

먹튀폴리스사칭

I don’t even know how I ended up here, but I thought this post was good. I don’t know who you are but definitely you’re going to a famous blogger if you are not already 😉 Cheers!

agrandar pene

Attractive section of content. I just stumbled upon your website and in accession capital to assert that I acquire in fact enjoyed account your blog posts.

Anyway I will be subscribing to your feeds and even I achievement

you access consistently quickly.

aumentar el tamano del pene

Hi there, just became alert to your blog through

Google, and found that it is truly informative. I am going to watch out for brussels.

I’ll be grateful if you continue this in future. Many people will be benefited from your writing.

Cheers!

agranda tu pene

I’m impressed, I have to admit. Rarely do I encounter a

blog that’s equally educative and engaging, and without a doubt,

you have hit the nail on the head. The issue is an issue

that too few men and women are speaking intelligently about.

Now i’m very happy I came across this during my search

for something regarding this.

para agrandar el pene

Very quickly this web page will be famous among all blogging viewers, due to it’s pleasant posts

agrandar pene

Hi there! Do you know if they make any plugins

to safeguard against hackers? I’m kinda paranoid

about losing everything I’ve worked hard on. Any recommendations?

geek squad tech support

I appreciate, cause I found exactly what I was looking for. You’ve ended my 4 day long hunt! God Bless you man. Have a great day. Bye

tamano del pene

WOW just what I was looking for. Came here by searching for

docket

para agrandar el pene

Heya i am for the primary time here. I came across this board

and I find It truly useful & it helped me out a lot.

I’m hoping to present one thing again and help others such as you helped me.

marcel van hooijdonk

of course like your website however you have to test the spelling on quite a few of your posts. Several of them are rife with spelling issues and I in finding it very bothersome to tell the reality nevertheless I’ll definitely come back again.

free target gift card

Interesting read , I’m going to spend more time researching this subject

mobile hacks

Would you be enthusiastic about exchanging links?

round the world ticket

Good web site! I truly love how it is easy on my eyes and the data are well written. I’m wondering how I might be notified whenever a new post has been made. I’ve subscribed to your feed which must do the trick! Have a nice day!

giving app

What’s Happening i’m new to this, I stumbled upon this I have found It absolutely helpful and it has helped me out loads. I hope to contribute & help other users like its helped me. Good job.

cesme eshot

thank you web site admin

fifa55

I’ll right away grab your rss as I can’t find your e-mail

subscription hyperlink or e-newsletter service. Do you have

any? Kindly allow me realize so that I may subscribe. Thanks.

bartenders

I will right away seize your rss feed as I can’t find your email subscription hyperlink or newsletter service. Do you have any? Please allow me know in order that I may just subscribe. Thanks.

beasttv

whoah this blog is excellent i love studying your articles. Stay up the great paintings! You already know, many people are hunting around for this information, you can help them greatly.

rich push review

Great post and right to the point. I am not sure if this is actually the best place to ask but do you guys have any thoughts on where to employ some professional writers? Thank you 🙂

eviction process

Great website. A lot of useful info here. I am sending it to several buddies ans also sharing in delicious. And naturally, thank you to your sweat!

good

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get bought an nervousness over that you wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly a lot often inside case you shield this hike.

야마토릴게임

hello!,I like your writing very so much! proportion we keep in touch extra approximately your post on AOL? I require a specialist in this house to unravel my problem. May be that is you! Taking a look forward to see you.

Bikini

Hello there, I found your site via Google while looking for a related topic, your site came up, it looks great. I’ve bookmarked it in my google bookmarks.

oxford

thank you web site admin

cesme esford

Amazing blog layout here. Was it hard creating a nice looking website like this?

Executive Condominium

As a Newbie, I am continuously searching online for articles that can help me. Thank you

Underground Elephant San Diego

Good – I should certainly pronounce, impressed with your website. I had no trouble navigating through all the tabs as well as related information ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your client to communicate. Excellent task..

seo de verdade

Thanks for your article. It’s very unfortunate that over the last one decade, the travel industry has had to take on terrorism, SARS, tsunamis, flu virus, swine flu, and also the first ever true global recession. Through it all the industry has proven to be solid, resilient along with dynamic, obtaining new strategies to deal with hardship. There are continually fresh difficulties and the opportunity to which the business must yet again adapt and answer.

agen poker online

I think other web site proprietors should take this site as an model, very clean and fantastic user genial style and design, as well as the content. You are an expert in this topic!

poker

I was more than happy to search out this internet-site.I needed to thanks for your time for this excellent read!! I positively enjoying each little little bit of it and I’ve you bookmarked to check out new stuff you blog post.

location de voiture de prestige

I will immediately take hold of your rss feed as I can’t to find your e-mail subscription link or e-newsletter service. Do you have any? Please let me know so that I may just subscribe. Thanks.

Social media marketing agency

Hiya! I just wish to give a huge thumbs up for the great information you’ve gotten right here on this post. I can be coming again to your weblog for more soon.

situs poker online

Generally I don’t read post on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been amazed me. Thanks, quite nice article.

gay pride parade 2019

I like what you guys are usually up too. This type of clever work and reporting! Keep up the great works guys I’ve included you guys to blogroll.

izmir escort bayanlar

Amazing blog layout here. Was it hard creating a nice looking website like this?

poker online

Great – I should certainly pronounce, impressed with your website. I had no trouble navigating through all the tabs and related information ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your client to communicate. Nice task..

mustang

I just want to say I am very new to blogs and truly savored you’re web site. More than likely I’m likely to bookmark your website . You amazingly come with superb articles and reviews. Regards for sharing your webpage.

binary.com digits under strategy

Definitely consider that that you stated. Your favorite reason seemed to be at the net the simplest thing to have in mind of. I say to you, I definitely get irked whilst people think about issues that they plainly do not recognise about. You controlled to hit the nail upon the top and also outlined out the whole thing with no need side-effects , other people could take a signal. Will likely be back to get more. Thank you

מצלמות אבטחה לעסק

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored material stylish. nonetheless, you command get bought an impatience over that you wish be delivering the following. unwell unquestionably come more formerly again as exactly the same nearly very often inside case you shield this increase.

agen poker online

That is the appropriate blog for anybody who wants to find out about this topic. You realize a lot its almost onerous to argue with you (not that I truly would need…HaHa). You undoubtedly put a new spin on a topic thats been written about for years. Nice stuff, simply nice!

dentist

Hello there! I know this is kinda off topic but I was wondering if you knew where I could find a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

Florida Medical Marijuana Card

I really wanted to send a simple note so as to express gratitude to you for some of the splendid tactics you are placing at this website. My incredibly long internet lookup has now been honored with excellent facts to talk about with my friends and family. I would claim that most of us website visitors are really lucky to be in a very good place with many brilliant professionals with interesting secrets. I feel pretty privileged to have discovered your entire webpages and look forward to some more amazing moments reading here. Thanks a lot again for all the details.

lån

I have seen that charges for internet degree professionals tend to be a fantastic value. Like a full Bachelors Degree in Communication from The University of Phoenix Online consists of 60 credits with $515/credit or $30,900. Also American Intercontinental University Online makes available Bachelors of Business Administration with a full program element of 180 units and a worth of $30,560. Online learning has made getting your diploma been so cool because you might earn the degree through the comfort of your abode and when you finish from office. Thanks for all other tips I have really learned through the web site.

ford eskort

Nice blog right here! Additionally your website rather a lot up very fast! What host are you using? Can I am getting your associate hyperlink in your host? I want my web site loaded up as fast as yours lol

Google

Awesome write-up. I am a regular visitor of your website and appreciate you taking the time to maintain the excellent site. I will be a frequent visitor for a really long time.

casino online

Awesome write-up. I am a regular visitor of your web site and appreciate you taking the time to maintain the excellent site. I’ll be a regular visitor for a long time.

Ciptofurniture

Hiya, I am really glad I have found this information. Nowadays bloggers publish only about gossip and net stuff and this is really annoying. A good site with exciting content, this is what I need. Thank you for making this web site, and I will be visiting again. Do you do newsletters by email?

GarisInfo.com

Hi there. I found your blog by the use of Google at the same time as looking for a comparable topic, your web site got here up. It seems to be great. I have bookmarked it in my google bookmarks to come back then.

Joesph Fozaehi

Very well written.

Nonton Movie

Awesome post. I am a normal visitor of your blog and appreciate you taking the time to maintain the nice site. I’ll be a frequent visitor for a long time.

Badan Usaha Milik Negara

Awesome post. I am a normal visitor of your web site and appreciate you taking the time to maintain the nice site. I will be a frequent visitor for a long time.

blog informasi gadget terikini

Awesome write-up. I’m a normal visitor of your web site and appreciate you taking the time to maintain the nice site. I will be a regular visitor for a long time.

Live Streaming TV Online Indonesia

Hiya, I’m really glad I’ve found this info. Today bloggers publish only about gossip and net stuff and this is really annoying. A good web site with exciting content, this is what I need. Thank you for making this site, and I’ll be visiting again. Do you do newsletters by email?

Daftar UMR Terbaru

Hello there. I discovered your web site by means of Google even as looking for a comparable topic, your website got here up. It looks great. I’ve bookmarked it in my google bookmarks to come back then.

download film

Hi there. I discovered your web site via Google whilst looking for a related subject, your site got here up. It appears to be good. I’ve bookmarked it in my google bookmarks to come back then.

https://pickandpackandship.com/

Hiya, I am really glad I have found this information. Today bloggers publish just about gossip and net stuff and this is actually annoying. A good website with interesting content, that is what I need. Thanks for making this website, and I’ll be visiting again. Do you do newsletters by email?

menang parlay tidak dibayar

Awesome post. I am a normal visitor of your site and appreciate you taking the time to maintain the excellent site. I will be a frequent visitor for a really long time.

judi slot bonus terbesar

Hey there. I discovered your web site by means of Google whilst searching for a related topic, your web site came up. It appears great. I have bookmarked it in my google bookmarks to come back then.

edions

thank you web site admin

agen judi bola

Awesome write-up. I am a regular visitor of your site and appreciate you taking the time to maintain the nice site. I’ll be a frequent visitor for a long time.

situs judi bola bonus 100%

Hello there. I found your site by way of Google while searching for a similar topic, your site got here up. It looks great. I’ve bookmarked it in my google bookmarks to visit then.

Agen Bola Bonus 100%

Hey there. I discovered your site by way of Google at the same time as looking for a related subject, your site got here up. It appears to be good. I have bookmarked it in my google bookmarks to come back then.

promo judi slot

Awesome post. I am a normal visitor of your blog and appreciate you taking the time to maintain the excellent site. I’ll be a frequent visitor for a really long time.

bonus member 200% slot

Hiya, I am really glad I’ve found this information. Today bloggers publish only about gossip and web stuff and this is really frustrating. A good website with exciting content, that is what I need. Thank you for making this web-site, and I’ll be visiting again. Do you do newsletters by email?

website marketing

Good post. I learn something new and challenging on blogs I stumbleupon everyday.

It will always be interesting to read articles from

other authors and practice something from other sites.

link judi bola

Hiya, I’m really glad I’ve found this info. Today bloggers publish only about gossip and internet stuff and this is actually annoying. A good site with exciting content, that’s what I need. Thanks for making this web-site, and I’ll be visiting again. Do you do newsletters by email?

slot bonus member baru

Hiya, I’m really glad I’ve found this info. Nowadays bloggers publish only about gossip and net stuff and this is actually annoying. A good website with exciting content, that is what I need. Thank you for making this web-site, and I’ll be visiting again. Do you do newsletters by email?

polo gti

As I site possessor I believe the content matter here is rattling great , appreciate it for your hard work. You should keep it up forever! Best of luck.

itcbet

Hiya, I’m really glad I have found this information. Today bloggers publish only about gossip and web stuff and this is really annoying. A good website with exciting content, that is what I need. Thanks for making this site, and I will be visiting again. Do you do newsletters by email?

bonus 100% member baru sportsbook

Awesome write-up. I am a regular visitor of your website and appreciate you taking the time to maintain the excellent site. I will be a regular visitor for a really long time.

sbobet link alternatif

Hey there. I discovered your site by the use of Google whilst searching for a related subject, your site came up. It seems good. I have bookmarked it in my google bookmarks to come back then.

agen sabung ayam s128

Hey there. I found your web site via Google while looking for a comparable topic, your website got here up. It looks great. I’ve bookmarked it in my google bookmarks to come back then.

cara taruhan judi

Hello there. I discovered your website by the use of Google whilst looking for a related topic, your web site came up. It seems good. I have bookmarked it in my google bookmarks to visit then.

Digital Marketing Wien

Online Marketing Wien

99 nama Asmaul husna Arab, Latin Dan artinya

Awesome post. I’m a regular visitor of your web site and appreciate you taking the time to maintain the excellent site. I will be a frequent visitor for a long time.

Rangkuman materi sepak bola

Hiya, I am really glad I’ve found this info. Today bloggers publish only about gossip and web stuff and this is actually annoying. A good web site with exciting content, that is what I need. Thank you for making this web site, and I will be visiting again. Do you do newsletters by email?

vivo club

Awesome write-up. I’m a regular visitor of your website and appreciate you taking the time to maintain the excellent site. I’ll be a frequent visitor for a long time.

Lagu Anak Indonesia

Awesome post. I am a normal visitor of your web site and appreciate you taking the time to maintain the excellent site. I’ll be a frequent visitor for a long time.

boston car service

Hi there, of course this piece of writing is in fact pleasant and I have learned lot of things from it regarding blogging.

thanks.

komunitas smartphone android vivo

Hiya, I’m really glad I have found this info. Today bloggers publish only about gossip and web stuff and this is really frustrating. A good web site with interesting content, this is what I need. Thank you for making this website, and I’ll be visiting again. Do you do newsletters by email?

jasa aqiqah cilacap

Awesome post. I’m a regular visitor of your blog and appreciate you taking the time to maintain the excellent site. I will be a regular visitor for a really long time.

Jual Beli Laptop Bekas

Hiya, I’m really glad I’ve found this information. Today bloggers publish only about gossip and net stuff and this is really annoying. A good blog with exciting content, this is what I need. Thank you for making this web site, and I will be visiting again. Do you do newsletters by email?

cetak stiker hologram

Hiya, I’m really glad I’ve found this information. Nowadays bloggers publish only about gossip and web stuff and this is actually frustrating. A good site with interesting content, this is what I need. Thanks for making this web-site, and I will be visiting again. Do you do newsletters by email?

Download Anime Movie 2019 Subtitle Indonesia

Hello there. I discovered your website by the use of Google at the same time as searching for a related subject, your web site came up. It seems good. I’ve bookmarked it in my google bookmarks to come back then.

viagre

Amazing blog layout here. Was it hard creating a nice looking website like this?

tempat wisata di bogor

Hello there. I discovered your website by way of Google at the same time as looking for a related matter, your site got here up. It appears great. I’ve bookmarked it in my google bookmarks to come back then.

wisata di bogor

Hi there. I discovered your site via Google whilst looking for a similar subject, your website got here up. It appears good. I’ve bookmarked it in my google bookmarks to visit then.

nama bayi laki laki

Hello there. I found your blog via Google while looking for a comparable matter, your web site got here up. It seems good. I’ve bookmarked it in my google bookmarks to come back then.

situs casino online terpercaya

Hiya, I’m really glad I’ve found this info. Nowadays bloggers publish just about gossip and net stuff and this is actually annoying. A good site with interesting content, this is what I need. Thank you for making this web site, and I’ll be visiting again. Do you do newsletters by email?

situs poker online

Awesome write-up. I am a normal visitor of your web site and appreciate you taking the time to maintain the nice site. I’ll be a frequent visitor for a really long time.

profoser

Thank you, I’ve just been searching for information approximately this topic for a while and yours is the greatest I’ve came upon so far. However, what about the conclusion? Are you certain concerning the supply?

토토 사이트

I like what you guys are up too. Such clever work and reporting! Keep up the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂

situs poker online

Awesome write-up. I’m a regular visitor of your website and appreciate you taking the time to maintain the nice site. I will be a regular visitor for a long time.

situs poker online

Hey there. I discovered your blog by means of Google whilst searching for a related subject, your web site got here up. It appears to be good. I have bookmarked it in my google bookmarks to visit then.

domino ceme online

Hiya, I’m really glad I have found this info. Nowadays bloggers publish just about gossip and net stuff and this is actually annoying. A good blog with interesting content, that’s what I need. Thank you for making this web site, and I’ll be visiting again. Do you do newsletters by email?

situs poker online

Hi there. I discovered your site by means of Google whilst looking for a similar topic, your web site came up. It looks good. I have bookmarked it in my google bookmarks to visit then.

poker online

Hi there. I discovered your web site via Google even as searching for a comparable topic, your site got here up. It appears great. I’ve bookmarked it in my google bookmarks to come back then.

poker online terpercaya

Hello there. I found your web site by way of Google at the same time as searching for a comparable subject, your web site got here up. It seems to be good. I’ve bookmarked it in my google bookmarks to come back then.

poker online

Hey there. I discovered your blog via Google whilst looking for a similar subject, your web site got here up. It seems great. I’ve bookmarked it in my google bookmarks to visit then.

agen judi poker online

Awesome post. I am a regular visitor of your web site and appreciate you taking the time to maintain the nice site. I will be a frequent visitor for a long time.

situs poker terpercaya

Hiya, I’m really glad I have found this info. Today bloggers publish only about gossip and internet stuff and this is actually frustrating. A good web site with exciting content, that’s what I need. Thanks for making this website, and I will be visiting again. Do you do newsletters by email?

Palm Blossom Jakarta

Hi there. I found your blog via Google even as searching for a related matter, your site got here up. It appears good. I’ve bookmarked it in my google bookmarks to come back then.

토토 사이트

Heya i’m for the first time here. I found this board and I find It truly useful & it helped me out a lot. I hope to give something back and aid others like you helped me.

casino online terpercaya

Awesome post. I am a normal visitor of your website and appreciate you taking the time to maintain the nice site. I’ll be a frequent visitor for a long time.

judi slot online

Hiya, I’m really glad I have found this info. Today bloggers publish just about gossip and net stuff and this is really irritating. A good blog with exciting content, this is what I need. Thanks for making this website, and I will be visiting again. Do you do newsletters by email?

situs casino online terpercaya

Hello there. I discovered your website by way of Google whilst searching for a comparable subject, your web site got here up. It seems great. I have bookmarked it in my google bookmarks to come back then.

sarangkartu.com

Hiya, I am really glad I have found this information. Today bloggers publish just about gossip and web stuff and this is actually irritating. A good blog with interesting content, this is what I need. Thank you for making this web site, and I will be visiting again. Do you do newsletters by email?

lakupoker

Hey there. I found your website by way of Google whilst searching for a comparable topic, your website got here up. It appears to be great. I have bookmarked it in my google bookmarks to visit then.

sarangkartu.com

Hi there. I discovered your website by way of Google at the same time as searching for a similar topic, your web site got here up. It appears great. I have bookmarked it in my google bookmarks to come back then.

sarangkartu.org

Hiya, I’m really glad I’ve found this info. Nowadays bloggers publish only about gossip and internet stuff and this is really annoying. A good site with exciting content, that’s what I need. Thank you for making this site, and I will be visiting again. Do you do newsletters by email?

lakupkr.com

Hiya, I’m really glad I’ve found this information. Nowadays bloggers publish only about gossip and net stuff and this is really irritating. A good blog with exciting content, this is what I need. Thank you for making this website, and I’ll be visiting again. Do you do newsletters by email?

sarangkartu

Hello there. I found your website by the use of Google even as searching for a similar subject, your site got here up. It looks great. I have bookmarked it in my google bookmarks to come back then.

ahmet

thank you web site admin

yagiz

thank you web site admin

rlfi=hd:;si:15192377117449176960;mv:!1m2!1d51.8241957!2d5.1126927!2m2!1d51.5372439!2d4.4234361!3m12!1m3!1d138948.42239726178!2d4.7680644!3d51.6807198!2m3!1f0!2f0!3f0!3m2!1i502!2i337!4f13.1

Thank you for another magnificent post. The place else could anybody get that type of info

in such an ideal means of writing? I’ve a presentation next week,

and I’m on the look for such info.

우리카지노 사이트

That is the best weblog for anyone who desires to find out about this topic. You realize so much its almost arduous to argue with you (not that I actually would want…HaHa). You positively put a new spin on a subject thats been written about for years. Great stuff, simply nice!

Kristalpoker

Hiya, I’m really glad I’ve found this info. Nowadays bloggers publish just about gossip and net stuff and this is actually irritating. A good blog with interesting content, this is what I need. Thanks for making this site, and I’ll be visiting again. Do you do newsletters by email?

Bola88

Hiya, I am really glad I have found this information. Today bloggers publish only about gossip and net stuff and this is really irritating. A good blog with interesting content, that’s what I need. Thanks for making this web-site, and I will be visiting again. Do you do newsletters by email?

driver lexmark

Awesome write-up. I am a normal visitor of your website and appreciate you taking the time to maintain the excellent site. I will be a regular visitor for a really long time.

situs judi slot online

Hi there. I found your blog by the use of Google while looking for a similar matter, your web site got here up. It appears to be great. I have bookmarked it in my google bookmarks to come back then.

togel online terpercaya

Awesome post. I am a normal visitor of your blog and appreciate you taking the time to maintain the nice site. I will be a regular visitor for a long time.

vivo club

Hello there. I discovered your site by means of Google whilst searching for a comparable matter, your site got here up. It seems good. I have bookmarked it in my google bookmarks to visit then.

situs poker online terpopuler

Hiya, I am really glad I have found this info. Nowadays bloggers publish only about gossip and internet stuff and this is actually frustrating. A good web site with interesting content, this is what I need. Thanks for making this website, and I will be visiting again. Do you do newsletters by email?

komunitas smartphone android vivo

Hiya, I’m really glad I have found this info. Nowadays bloggers publish only about gossip and net stuff and this is really annoying. A good site with interesting content, this is what I need. Thanks for making this web-site, and I will be visiting again. Do you do newsletters by email?

forum diskusi pengguna vivo

Awesome post. I’m a normal visitor of your web site and appreciate you taking the time to maintain the nice site. I’ll be a frequent visitor for a long time.

situs poker online terpopuler

Hiya, I am really glad I’ve found this information. Today bloggers publish just about gossip and net stuff and this is really frustrating. A good web site with interesting content, that’s what I need. Thank you for making this web-site, and I’ll be visiting again. Do you do newsletters by email?

idn score

Hiya, I am really glad I have found this information. Nowadays bloggers publish only about gossip and internet stuff and this is actually irritating. A good web site with interesting content, this is what I need. Thanks for making this web-site, and I’ll be visiting again. Do you do newsletters by email?

Datasgp

Hiya, I am really glad I’ve found this info. Today bloggers publish just about gossip and internet stuff and this is actually annoying. A good blog with exciting content, this is what I need. Thanks for making this website, and I will be visiting again. Do you do newsletters by email?

Mrprediksi.net

Awesome write-up. I am a normal visitor of your web site and appreciate you taking the time to maintain the excellent site. I’ll be a frequent visitor for a really long time.

situs judi online

Hi there. I found your site via Google whilst searching for a similar topic, your website came up. It looks great. I have bookmarked it in my google bookmarks to visit then.

IC Cosultant

Hello there. I found your web site via Google even as looking for a similar matter, your website came up. It looks good. I have bookmarked it in my google bookmarks to come back then.

situs judi online

Awesome write-up. I am a normal visitor of your site and appreciate you taking the time to maintain the nice site. I will be a regular visitor for a long time.

situs poker online

Hiya, I’m really glad I’ve found this information. Today bloggers publish only about gossip and net stuff and this is actually annoying. A good website with exciting content, this is what I need. Thanks for making this website, and I will be visiting again. Do you do newsletters by email?

pokeridr.blog.fc2.com

Hiya, I’m really glad I have found this information. Nowadays bloggers publish just about gossip and web stuff and this is really frustrating. A good website with exciting content, that’s what I need. Thank you for making this website, and I’ll be visiting again. Do you do newsletters by email?

situs poker online

Hiya, I’m really glad I have found this information. Nowadays bloggers publish just about gossip and net stuff and this is really frustrating. A good site with exciting content, this is what I need. Thank you for making this web-site, and I will be visiting again. Do you do newsletters by email?

sejagadpoker.blogspot.com

Hiya, I am really glad I’ve found this information. Today bloggers publish just about gossip and web stuff and this is actually frustrating. A good site with interesting content, that’s what I need. Thanks for making this web-site, and I’ll be visiting again. Do you do newsletters by email?

buku mimpi

Hi there. I found your website via Google whilst looking for a similar topic, your site came up. It appears to be great. I’ve bookmarked it in my google bookmarks to come back then.

royalflush88

Hey there. I found your site by the use of Google at the same time as searching for a similar topic, your web site came up. It appears good. I have bookmarked it in my google bookmarks to visit then.

cara membedakan oli palsu

Hey there. I discovered your blog by the use of Google even as looking for a related matter, your site came up. It looks good. I have bookmarked it in my google bookmarks to visit then.

sobat poker88

Hiya, I am really glad I’ve found this info. Today bloggers publish only about gossip and net stuff and this is really annoying. A good web site with exciting content, this is what I need. Thanks for making this web site, and I will be visiting again. Do you do newsletters by email?

Hoya Jackpot poker88

Awesome write-up. I am a regular visitor of your blog and appreciate you taking the time to maintain the excellent site. I will be a regular visitor for a really long time.

ovo poker

Hi there. I found your blog by way of Google at the same time as looking for a comparable topic, your site got here up. It appears great. I’ve bookmarked it in my google bookmarks to visit then.

parti

thank you web site admin

אוזניות

Generally I do not learn post on blogs, however I would like to say that this write-up very compelled me to try and do so! Your writing taste has been amazed me. Thanks, very nice article.

buku mimpi

Hey there. I discovered your site via Google even as searching for a similar topic, your web site came up. It appears to be good. I’ve bookmarked it in my google bookmarks to come back then.

royalflush poker88

Awesome write-up. I am a normal visitor of your web site and appreciate you taking the time to maintain the excellent site. I’ll be a frequent visitor for a long time.

bandarkiu

Awesome post. I am a normal visitor of your website and appreciate you taking the time to maintain the nice site. I will be a frequent visitor for a long time.

togel singapura

Hiya, I’m really glad I have found this information. Nowadays bloggers publish just about gossip and internet stuff and this is actually irritating. A good blog with interesting content, that’s what I need. Thank you for making this web-site, and I will be visiting again. Do you do newsletters by email?

dadu online

Awesome write-up. I am a normal visitor of your blog and appreciate you taking the time to maintain the excellent site. I will be a regular visitor for a long time.

notext

Hi there. I discovered your web site by way of Google at the same time as looking for a similar subject, your web site came up. It appears to be good. I have bookmarked it in my google bookmarks to visit then.

capsa susun online

Awesome write-up. I am a regular visitor of your website and appreciate you taking the time to maintain the excellent site. I will be a frequent visitor for a long time.

Pokerace99

Awesome post. I am a regular visitor of your website and appreciate you taking the time to maintain the excellent site. I will be a frequent visitor for a really long time.

daftar sbobet

Hiya, I’m really glad I have found this information. Nowadays bloggers publish just about gossip and net stuff and this is actually annoying. A good blog with exciting content, that’s what I need. Thank you for making this website, and I will be visiting again. Do you do newsletters by email?

jual beli laptop Jakarta

Awesome write-up. I’m a normal visitor of your site and appreciate you taking the time to maintain the nice site. I’ll be a regular visitor for a really long time.

Laundry kiloan premium

Hello there. I discovered your web site by means of Google at the same time as looking for a similar topic, your web site got here up. It seems good. I’ve bookmarked it in my google bookmarks to visit then.

judi bola terpercaya

Awesome write-up. I am a regular visitor of your website and appreciate you taking the time to maintain the excellent site. I will be a regular visitor for a really long time.

mesin inkjet coding