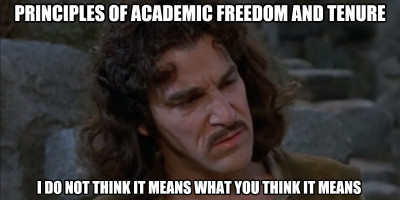

This whole story seems like it’s just a bit too complex for most media sources. I think only the Roanoke Times has both delved deeply into it and come out with a reasonable perspective. This is a short blog post to give a representative example why this story is so difficult.

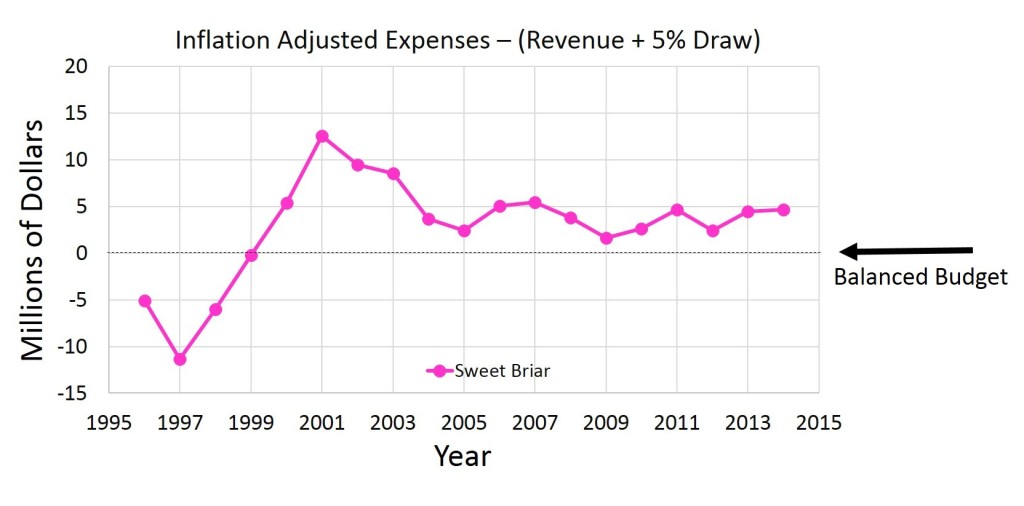

Figure 1 is a graph that is basically Sweet Briar’s real deficit over almost twenty years. It averages a little less than $3 million/year. When I see this graph, I don’t see hopeless, but absent any context, I can see why it could convince others of some of what the Sweet Briar board is saying.

Sweet Briar Colleges deficit since the 1996-1997 school year. This value is obtained by subtracting the sum of the operating revenue and $4.5 million from the operating expenses. The $4.5 million represents a 5% draw off a $90 million endowment. A balanced budget for Sweet Briar would involve not having a deficit after a 5% endowment draw. Since 1996-1997, the average deficit is a little under $3 million/year

But context is everything, and there are a lot of little pieces that have to be taken into account. The huge deficits in the early 2000s reflect a lot of spending on infrastructure meant to serve as a foundation for decades to come, but it appears now that some of that spending may have been excessive.

It is true that under President Jo Ellen Parker, the march towards a balanced budget stalled, but this was mostly due to President Parker implementing a revenue-draining recruiting/financial aid strategy and a choice not to hire a Dean of Enrollment, choices that cost around $5 million/year. Things wouldn’t look so bad right now with an additional $5 million/year.

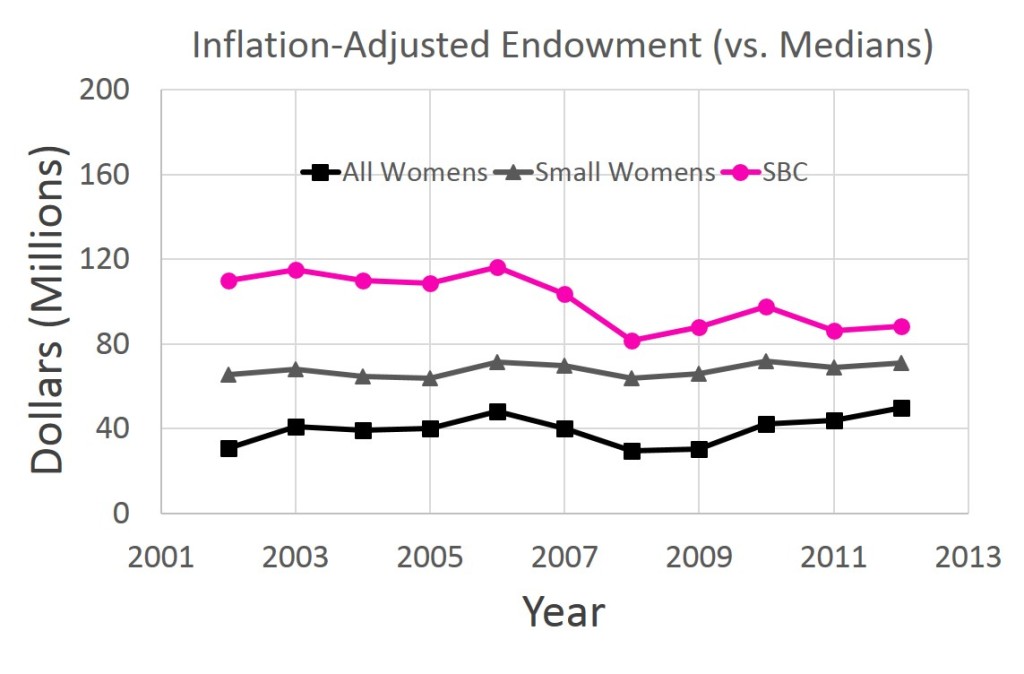

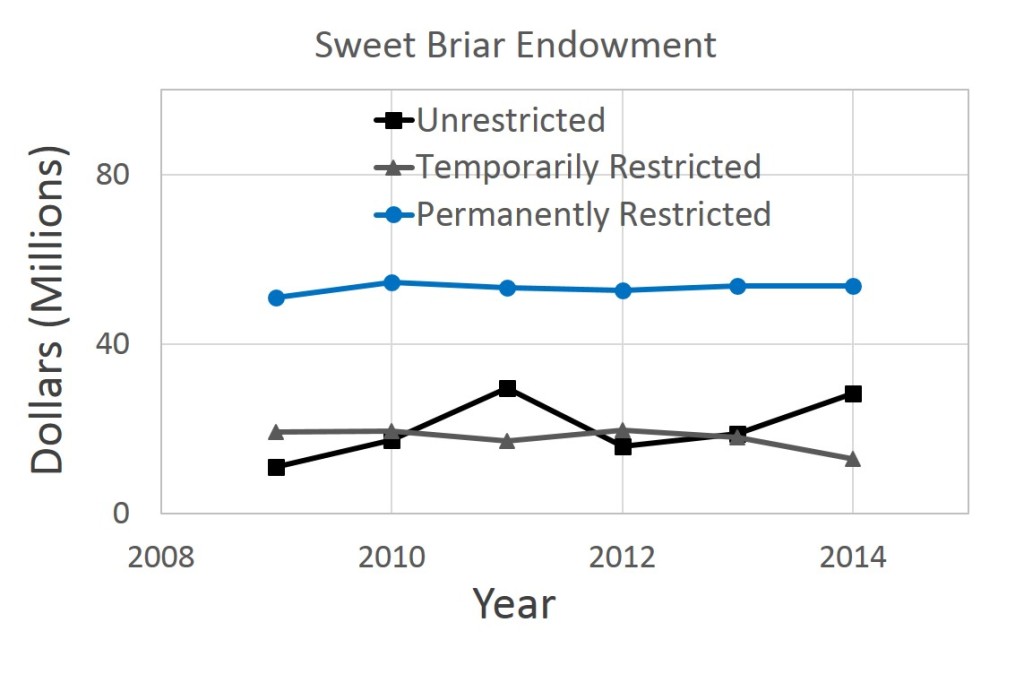

Figures 2 and 3 show that even though Sweet Briar has mismanaged its way into getting about as little in tuition revenue as is possible – and I think anyone comfortable with noise trends, regression to the mean, or modeling of probabilistic processes would see that things were at a temporary low point – the situation did not deteriorate. The endowment – unrestricted, temporarily restricted, and permanently restricted – has not gone down in the last 6 years. It’s true that Sweet Briar did not take advantage of a stock market rise during that time, but it’s in no worse shape for it, financially. At the same time, Sweet Briar has cut expenses, and it’s learned that a particular recruiting/financial aid strategy is a revenue disaster.

Sweet Briar College endowment compared to (almost) all women’s colleges (42) and a group of 14 small women’s college close to the size of Sweet Briar. Each data point represents the endowment at the end of the fiscal year, so the last data point represents the endowment at the end of June, 2013 (sorry for the labeling confusion).

Sweet Briar College’s inflation-adjusted endowment at the beginning of the fiscal year, broken down by level of restriction. Last data point is on 6/30/2014. Sweet Briar did not take advantage of a favorable stock market, but it’s position did not deteriorate, either.

With all that as context, and knowing that Sweet Briar had $28 million in unrestricted funds as of 6/30/2014 and several more million in temporarily restricted funds that could easily have been converted, would anyone really say that it was clear Sweet Briar had a hopelessly failing business model and so had to close? I’m not an optimist, but that doesn’t seem anywhere near hopeless.

But, for that conclusion, much context is needed. It is true that Sweet Briar has been running a deficit and spending more in the endowment than it should. It is also true that Sweet Briar has a viable business model. Understanding both of those simultaneously is what is difficult.

Suryadih

Keep these arictles coming as they’ve opened many new doors for me.

best children`s cancer research charities

Where can I start a personal blog about anything & everything?

free download for laptop pc

Perfectly written written content , thankyou for selective information.

office removal services london

I thought it was going to be some boring old post, but it really compensated for my time. I will post a link to this page on my blog site. I am confident my visitors will come across that very useful

visit website

wow, awesome post.Much thanks again. Really Great.

full apps download

such detailed about my trouble. You are incredible!

suba suba

zJ8095 Very good information. Lucky me I discovered your site by chance (stumbleupon). I have bookmarked it for later!

โกงเงิน call of duty mobile hack ตัวละคร

Muchos Gracias for your article post.Much thanks again. Really Cool.

apps download for pc

There is definately a great deal to learn about this subject. I love all of the points you made.

app for pc download

I was recommended this web site by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my difficulty. You are incredible! Thanks!

pc games for windows 8

wonderful post, very informative. I wonder why the other specialists of this sector don at notice this. You must continue your writing. I am confident, you ave a huge readers a base already!

gamefly

Your way of describing everything in this piece of writing is

really fastidious, all be able to effortlessly be aware of it,

Thanks a lot.

gamefly free trial

Oh my goodness! Awesome article dude! Thank you so much, However I am experiencing difficulties with

your RSS. I don’t know why I cannot join it.

Is there anybody else getting similar RSS issues? Anybody who

knows the answer will you kindly respond? Thanx!!

apps download for windows 7

Keep up the great work, I read few articles on this web site and I believe that your website is real interesting and contains bands of fantastic info.

click here

This very blog is definitely awesome as well as diverting. I have found helluva interesting advices out of this blog. I ad love to go back every once in a while. Thanks a lot!

free apps for pc download

I think other site proprietors should take this website as an model, very clean and great user friendly style and design, as well as the content. You are an expert in this topic!

apk download for windows 7

Wonderful post! We are linking to this particularly great post on our website. Keep up the great writing.

gamefly free trial

It’s remarkable in support of me to have a site, which is

good for my experience. thanks admin

apk free download for windows 7

Woah! I am really enjoying the template/theme of this

gamefly

Pretty component to content. I simply stumbled upon your site and in accession capital to assert that I get in fact enjoyed account your blog posts.

Anyway I’ll be subscribing in your feeds or even I achievement you access persistently

quickly.

gamefly

My brother recommended I might like this website.

He was entirely right. This post actually made my day.

You can not imagine simply how much time

I had spent for this info! Thanks!

freelance seo consultant

website yourself or did you hire someone to do it for you?

minecraft download mojang

Hi there mates, how is all, and what you would like to say concerning this post, in my view its really remarkable designed for me.

pc games for windows 8

I truly appreciate people like you! Take care!!

minecraft download free

Hello, I enjoy reading all of your article post.

I like to write a little comment to support you.

minecraft download free pc

What a material of un-ambiguity and preserveness of precious knowledge about unexpected feelings.

free apk for pc download

Why do copyright holders only allow people from certain countries to view their content?

Tech Blog

Really enjoyed this article.Really thank you! Fantastic.

more details

This blog is amazaing! I will be back for more of this !!! WOW!

download minecraft pc

I want to to thank you for this wonderful read!!

I absolutely loved every little bit of it. I

have got you saved as a favorite to check out new stuff you post…

g

Hello to every , because I am actually eager of reading this weblog’s post to be updated on a

regular basis. It carries nice information.

g

Wonderful post however I was wanting to know

if you could write a litte more on this subject?

I’d be very grateful if you could elaborate a

little bit more. Thanks!

g

Every weekend i used to pay a visit this site, for the reason that i wish for enjoyment, as this this site conations truly nice funny stuff too.

g

Heya i’m for the first time here. I came across this

board and I to find It truly helpful & it helped me out much.

I hope to offer something again and help others like you helped

me.

minecraft free download pc

It’s perfect time to make some plans for the future and it is

time to be happy. I’ve read this submit and if I could I

desire to suggest you few fascinating issues or tips. Maybe you can write next articles referring to this article.

I wish to learn more issues about it!

g

Hello there, just became alert to your blog through Google, and found that it is really informative.

I’m gonna watch out for brussels. I will appreciate if you continue this in future.

A lot of people will be benefited from your writing. Cheers!

minecraft download free pc

I’m gone to inform my little brother, that he

should also pay a visit this web site on regular basis to get updated from hottest news update.

free minecraft download

Wonderful beat ! I wish to apprentice even as you

amend your web site, how could i subscribe for a

weblog web site? The account aided me a appropriate deal.

I had been a little bit acquainted of this your broadcast offered bright clear concept

minecraft download for free

At this time it looks like BlogEngine is the best blogging platform available right now.

(from what I’ve read) Is that what you are

using on your blog?

download minecraft pc

Hmm it seems like your blog ate my first comment (it was extremely

long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog blogger but I’m still new to the whole thing.

Do you have any tips for inexperienced blog writers? I’d really appreciate it.

minecraft download free pc

Link exchange is nothing else except it is simply placing the other person’s webpage link on your page at proper place and other person will also do same for you.

Stepnot

Tomar Viagra Yahoo Brand Name Propecia Hair Growth Levitra Mit Rezept cialis Cheap Female Viagra Viagra With Online Consultation Online Pahrmacies

ps4 games 2014-15

Thanks on your marvelous posting! I definitely enjoyed reading it,

you may be a great author.I will always bookmark your blog and will

eventually come back in the future. I want to encourage

continue your great work, have a nice afternoon!

gamefly free trial 2019 coupon

It is perfect time to make some plans for the future and it is time to be happy.

I’ve read this post and if I could I wish to

suggest you some interesting things or tips. Maybe you

could write next articles referring to this article.

I want to read more things about it!

ps4 best games ever made 2019

Hello, I enjoy reading through your article. I like

to write a little comment to support you.

ps4 best games ever made 2019

Hello, I think your web site may be having internet browser compatibility issues.

When I take a look at your site in Safari, it looks fine however

when opening in Internet Explorer, it has some overlapping issues.

I simply wanted to provide you with a quick heads up!

Apart from that, great site!

Stepnot

Cialis E Desiderio Acquistare Kamagra Miglior Sito Zithromax Medicine cialis for sale Cyclophosphamide For Sale In Mexico

quest bars cheap

Greetings from California! I’m bored at work so I decided to check out your blog on my iphone

during lunch break. I enjoy the information you present here and can’t

wait to take a look when I get home. I’m amazed at how fast your

blog loaded on my phone .. I’m not even using WIFI,

just 3G .. Anyways, excellent blog!

quest bars cheap

I really like looking through an article that can make people think.

Also, thanks for allowing for me to comment!

quest bars

Thanks for your personal marvelous posting! I quite enjoyed reading it, you will be a great author.

I will always bookmark your blog and will eventually come back from now on.

I want to encourage you to continue your great job, have a nice day!

node

I must express my affection for your kindness giving support to those people who really need assistance with in this situation. Your special dedication to getting the message throughout had become rather advantageous and has really permitted most people like me to reach their endeavors. Your entire interesting key points entails so much to me and still more to my office colleagues. Regards; from each one of us.

tinyurl.com

Wonderful blog! I found it while searching on Yahoo News.

Do you have any tips on how to get listed in Yahoo News? I’ve been trying for

a while but I never seem to get there! Appreciate it

yeezy boost 350

I happen to be commenting to make you know of the fabulous discovery my friend’s child enjoyed visiting yuor web blog. She came to find a good number of issues, including what it’s like to have a marvelous coaching spirit to have the others with ease grasp some multifaceted things. You really exceeded visitors’ expected results. I appreciate you for showing these essential, trustworthy, explanatory as well as cool tips on your topic to Ethel.

plenty of fish dating site

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or

something. I think that you could do with some pics to drive the

message home a little bit, but instead of that, this is

fantastic blog. A great read. I’ll definitely be back.

Stepnot

Kamagra Oral Jelly Oder Tabletten Cialis Para La Disfuncion Erectil cialis To Buy Tadalis Sx Soft Doxycycline Monohydrate Canada

quest bars cheap

Unquestionably believe that which you said. Your favorite

justification appeared to be on the net the easiest thing

to be aware of. I say to you, I definitely get irked while people

think about worries that they just don’t know about.

You managed to hit the nail upon the top and defined out the whole thing without having side effect , people could take a signal.

Will probably be back to get more. Thanks

Coleman Leavell

That is the right weblog for anybody who desires to search out out about this topic. You understand so much its virtually hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Nice stuff, simply great!

suba suba

jjy1YX Im no professional, but I believe you just made the best point. You clearly understand what youre talking about, and I can really get behind that. Thanks for being so upfront and so truthful.

how to get help in windows 10

I was extremely pleased to uncover this web site. I wanted to thank you for ones time just for this wonderful read!!

I definitely really liked every little bit of it

and i also have you book marked to see new information in your site.

A00-280 Syllabus

Utterly pent articles, appreciate it for information. He who establishes his argument by noise and command shows that his reason is weak. by Michel de Montaigne.

medicina

I value the article post.Really looking forward to read more. Keep writing.

http://tinyurl.com/yyyb2ron

Ahaa, its fastidious conversation concerning this piece of writing at this place at this

blog, I have read all that, so at this time me also commenting here.

His Secret Obsession Reviews

You have brought up a very fantastic points , thankyou for the post.

so sanh gia

You can definitely see your expertise within the work you write. The sector hopes for even more passionate writers like you who aren at afraid to say how they believe. All the time follow your heart.

hermes birkin

I together with my buddies were taking note of the great things on your web page while instantly I got an awful feeling I had not expressed respect to the website owner for those secrets. All the guys are actually so glad to learn all of them and have in reality been making the most of those things. Thanks for actually being quite kind and also for settling on varieties of remarkable themes most people are really desperate to understand about. My personal honest apologies for not expressing appreciation to earlier.

ralph lauren uk

Thank you so much for giving everyone remarkably spectacular chance to read articles and blog posts from this site. It is often so beneficial and as well , stuffed with fun for me and my office acquaintances to visit your blog no less than thrice every week to read through the fresh guides you have. Of course, I am just actually fulfilled concerning the striking thoughts you give. Some 3 ideas in this post are undoubtedly the very best we’ve had.

Nicholas Markevich

I have read a few excellent stuff here. Definitely value bookmarking for revisiting. I wonder how much effort you place to create one of these fantastic informative web site.

ทําจมูกที่ไหนดี

Usually I don at learn post on blogs, but I wish to say that this write-up very pressured me to take a look at and do it! Your writing style has been amazed me. Thanks, very nice post.

fire extinguisher installation

You made some really good points there. I looked on the web to learn more about the issue and found most people will go along with your views on this website.

james harden shoes

I wanted to post you that very little word so as to thank you so much as before on your precious opinions you’ve shown above. It has been shockingly open-handed of people like you to present unhampered precisely what most of us could possibly have supplied for an e book to help make some profit for their own end, principally seeing that you might have done it in the event you decided. The good tips likewise served to provide a fantastic way to be certain that the rest have the same zeal similar to my own to figure out way more around this issue. I’m certain there are thousands of more enjoyable occasions up front for many who scan through your site.

yeezy shoes

My spouse and i got quite glad when John managed to finish off his preliminary research through the precious recommendations he made from your own web pages. It is now and again perplexing just to possibly be handing out secrets and techniques that people today have been making money from. And now we know we have the writer to be grateful to because of that. The main illustrations you’ve made, the simple blog menu, the relationships you can help instill – it’s got mostly sensational, and it’s leading our son and us know that that theme is thrilling, which is certainly pretty fundamental. Thank you for everything!

sim 4g chau au

Thanks a lot for the blog article. Much obliged.

Vakansii nedvizhimost'

time to look over it all at the moment but I have saved it and also added in your RSS feeds, so when

CCNP 300-475 Exam Topics

Thank you for helping out, excellent info.

Cua go cong nghiep

Wow, great blog post.Really looking forward to read more. Keep writing.

curry 4 shoes

My spouse and i ended up being fulfilled when Jordan could conclude his preliminary research from the precious recommendations he received in your weblog. It is now and again perplexing to simply be giving away hints that many people today have been selling. So we keep in mind we have you to thank for this. Most of the explanations you made, the easy site menu, the relationships you can help to foster – it’s everything wonderful, and it is assisting our son and our family do think this subject matter is exciting, and that is wonderfully serious. Thanks for all!

fila

I want to express thanks to the writer just for bailing me out of this type of condition. Because of surfing throughout the online world and getting techniques that were not productive, I figured my life was over. Existing without the presence of approaches to the difficulties you’ve solved by means of your entire review is a crucial case, and those that would have badly affected my career if I had not encountered your blog post. The understanding and kindness in controlling the whole lot was excellent. I don’t know what I would have done if I hadn’t encountered such a thing like this. I can at this point relish my future. Thanks so much for this high quality and sensible guide. I won’t be reluctant to suggest your web page to any individual who needs to have care on this issue.

Stanford Pelage

Outstanding post, I conceive people should learn a lot from this weblog its real user genial. So much wonderful information on here :D.

Stepnot

Dauerstander Ohne Viagra Side Effects From Amoxicillin viagra Cialis Versus Propecia

offwhite

I intended to compose you one tiny note just to thank you so much the moment again considering the exceptional principles you’ve documented in this case. It has been simply remarkably generous of people like you to make openly what numerous people could possibly have supplied as an e-book in making some money on their own, principally considering the fact that you could possibly have done it if you decided. The secrets additionally served to be the easy way to understand that most people have the same eagerness just as my personal own to know way more when considering this problem. I believe there are some more enjoyable opportunities up front for people who see your site.

yeezy boost

I am often to blogging and i actually appreciate your content. The article has really peaks my interest. I am going to bookmark your web site and keep checking for brand new information.

jordan shoes

Needed to draft you a very small remark so as to thank you the moment again for your great solutions you’ve provided here. It’s quite pretty open-handed with you to convey extensively exactly what many of us would have offered as an ebook in making some dough for themselves, mostly considering the fact that you could possibly have tried it if you ever desired. These techniques as well served like the fantastic way to be aware that other people online have a similar zeal much like my very own to find out good deal more concerning this matter. I am sure there are numerous more pleasant opportunities ahead for people who looked over your blog.

cheap jordans

I have to show appreciation to you just for bailing me out of this difficulty. Just after researching through the online world and meeting techniques which were not productive, I was thinking my life was done. Living devoid of the solutions to the issues you have solved as a result of this posting is a serious case, as well as the kind which may have in a negative way affected my career if I hadn’t come across your web blog. Your own personal talents and kindness in controlling every aspect was useful. I am not sure what I would have done if I had not discovered such a step like this. It’s possible to now look ahead to my future. Thanks so much for your reliable and results-oriented help. I will not hesitate to suggest your site to anyone who requires assistance on this situation.

evropski univerzitet

I wanted to thank you for this great article, I definitely loved each and every little bit of it. I have bookmarked your web site to look at the newest stuff you post.

yeezy boost 350

I must voice my appreciation for your generosity giving support to visitors who should have help on the matter. Your personal commitment to getting the message all around appears to be exceptionally advantageous and have without exception encouraged men and women much like me to attain their endeavors. Your entire insightful information indicates this much a person like me and substantially more to my peers. Many thanks; from each one of us.

nike air huarache

I wish to show my gratitude for your generosity in support of those people who really want help on that field. Your real dedication to passing the solution all-around came to be extraordinarily insightful and have always allowed somebody much like me to achieve their goals. This invaluable facts signifies a lot a person like me and still more to my fellow workers. Best wishes; from everyone of us.

thuoc synacthen depot

I’аve read various fantastic stuff here. Undoubtedly worth bookmarking for revisiting. I surprise how a whole lot try you set to generate this form of great informative internet site.

Bronwyn

Wow, great blog.Much thanks again. Keep writing.

Flavia

I think this is a real great blog post. Much obliged.

yeezy shoes

I simply wanted to write a simple remark to be able to express gratitude to you for these unique strategies you are posting at this site. My time intensive internet lookup has at the end been honored with reasonable knowledge to write about with my classmates and friends. I ‘d admit that we visitors are extremely fortunate to live in a really good site with many special individuals with useful advice. I feel somewhat fortunate to have discovered your website page and look forward to many more amazing minutes reading here. Thanks once more for a lot of things.

quest bars cheap 2019 coupon

Asking questions are really fastidious thing if you are

not understanding anything totally, except this paragraph presents nice

understanding yet.

michael kors outlet online

I wish to express my appreciation to the writer for bailing me out of this particular predicament. Right after looking through the internet and getting recommendations which were not beneficial, I thought my life was well over. Existing without the approaches to the difficulties you’ve resolved as a result of your main short article is a crucial case, as well as the ones that would have in a negative way affected my career if I hadn’t encountered your website. Your natural talent and kindness in controlling all areas was valuable. I don’t know what I would have done if I had not come across such a point like this. I can also now look forward to my future. Thanks so much for this skilled and amazing guide. I won’t think twice to endorse your web page to any individual who would like guidelines on this problem.

goyard handbags

My spouse and i got absolutely more than happy Ervin managed to finish up his investigation with the precious recommendations he obtained through the web page. It is now and again perplexing to simply possibly be giving out secrets and techniques which often many people have been making money from. We really fully understand we have the writer to appreciate for this. All the explanations you made, the simple web site menu, the relationships you will make it easier to create – it’s got everything astonishing, and it’s really facilitating our son and our family believe that this idea is thrilling, which is certainly extraordinarily essential. Many thanks for the whole thing!

Stepnot

Buy Celexa Online Cheap levitra generique en france cialis Propecia Buy Uk Amoxicillin Powered By Phpbb

nike lebron 15

I wanted to put you a very little word to say thank you the moment again for your remarkable pointers you have documented above. This is certainly surprisingly generous of you to offer publicly all that some people might have made available as an e book to make some dough on their own, principally seeing that you might well have tried it if you ever decided. The tricks as well worked like a great way to comprehend other individuals have the same fervor similar to my own to know much more in respect of this issue. I am sure there are a lot more pleasant periods up front for those who look over your blog.

yeezy boost 350

This web page can be a walk-by for the entire info you wished about this and didn抰 know who to ask. Glimpse here, and also you抣l positively discover it.

nike air max 90

I not to mention my guys came checking the best suggestions on the website and so quickly I had a horrible feeling I had not expressed respect to the site owner for those secrets. These men appeared to be certainly happy to learn all of them and have now truly been enjoying these things. I appreciate you for indeed being well considerate and then for going for certain decent things millions of individuals are really wanting to discover. Our own sincere regret for not saying thanks to sooner.

quest bars cheap

I think this is among the most significant info for me.

And i am glad reading your article. But wanna remark on some general things, The website style is wonderful,

the articles is really great : D. Good job, cheers

louboutin shoes

I must point out my admiration for your kind-heartedness for folks that must have help with this important situation. Your personal dedication to passing the message throughout became certainly valuable and have consistently made ladies much like me to achieve their ambitions. Your entire warm and friendly useful information implies a great deal to me and still more to my office workers. Best wishes; from all of us.

Executive office Chairs

I value the article post.Really thank you! Fantastic.

golden goose sneakers

I actually wanted to make a small message so as to say thanks to you for all of the magnificent recommendations you are giving on this website. My time-consuming internet lookup has at the end been rewarded with reputable information to go over with my companions. I would declare that we website visitors actually are undoubtedly fortunate to live in a perfect site with many outstanding professionals with beneficial plans. I feel really privileged to have used the webpages and look forward to tons of more fun moments reading here. Thanks once again for all the details.

adidas yeezy

Thanks a lot for giving everyone remarkably spectacular chance to read from this website. It is always very superb and jam-packed with a lot of fun for me personally and my office fellow workers to visit your site really thrice every week to find out the latest guidance you have. Not to mention, I am also always pleased for the outstanding strategies you give. Certain two areas in this article are absolutely the simplest we have had.

แทงบอล

You don at have to remind Air Max fans, the good people of New Orleans.

yeezy boost

I as well as my friends ended up reading the best guidelines found on the blog and all of a sudden got an awful suspicion I had not thanked you for those tips. All of the young boys were as a result thrilled to read through them and have now in reality been loving those things. We appreciate you being considerably accommodating and for having these kinds of cool useful guides most people are really wanting to know about. My very own sincere apologies for not expressing appreciation to you sooner.

yeezy wave runner 700

I and also my friends ended up checking the best pointers from your web site and so before long came up with a terrible suspicion I had not expressed respect to the web site owner for those secrets. My women were definitely for that reason excited to learn all of them and have absolutely been taking advantage of these things. Appreciation for getting considerably considerate as well as for opting for this kind of wonderful subject areas millions of individuals are really desperate to learn about. My personal honest regret for not expressing appreciation to you earlier.

air max 97

I not to mention my buddies were looking through the nice items from your web blog and quickly I got a terrible feeling I never thanked the web blog owner for them. These young men are already absolutely stimulated to read through them and have in effect in truth been tapping into those things. We appreciate you indeed being considerably accommodating and for using variety of wonderful subject areas most people are really desirous to understand about. My personal sincere regret for not expressing gratitude to sooner.

yeezy boost 350

You made some respectable points there. I regarded on the internet for the difficulty and located most people will go together with with your website.

coach factory outlet

I needed to draft you one little bit of remark to say thanks as before just for the remarkable basics you have provided on this page. This is quite extremely open-handed of you to present without restraint what most of us might have advertised as an ebook in order to make some profit on their own, chiefly now that you could have done it if you decided. The good ideas in addition acted as the good way to fully grasp that other individuals have a similar zeal much like mine to know much more with respect to this matter. I think there are lots of more pleasant instances up front for individuals who examine your site.

super affiliate system review

It as going to be finish of mine day, but before ending I am reading this enormous post to improve my knowledge.

ferragamo belt

I enjoy you because of every one of your effort on this website. Gloria really loves doing research and it’s really easy to understand why. Most people know all of the dynamic method you deliver precious steps through this blog and even improve contribution from people on this idea then our simple princess is undoubtedly studying so much. Take pleasure in the rest of the new year. You’re the one performing a useful job.

plenty of fish dating site

Have you ever considered about adding a little bit more than just your

articles? I mean, what you say is important and all.

But imagine if you added some great photos or video clips

to give your posts more, “pop”! Your content is

excellent but with images and videos, this site could undeniably be

one of the greatest in its field. Very good blog!

promos

You are my aspiration, I possess few blogs and infrequently run out from brand . Follow your inclinations with due regard to the policeman round the corner. by W. Somerset Maugham.

codes

Keep up the superb piece of work, I read few posts on this website and I believe that your site is really interesting and has got circles of great info.

deal

Some genuinely nice and utilitarian information on this internet site, too I believe the design contains superb features.

coupon

Major thanks for the article post.Thanks Again. Really Great.

clearance school uniforms

you employ a fantastic weblog here! want to earn some invite posts on my website?

dau thuy luc

time and yours is the greatest I ave came upon so far. However, what in regards to the bottom

goyard bags

I precisely wanted to thank you very much yet again. I do not know what I might have carried out in the absence of those secrets shared by you concerning such theme. It has been the daunting problem for me, however , finding out a new specialised manner you managed it forced me to leap with contentment. Now i’m grateful for the assistance as well as trust you are aware of a great job you are doing training men and women through the use of your web site. Most likely you haven’t come across all of us.

rescator

whoah this blog is great i love reading your articles. Keep up the good work! You know, lots of people are searching around for this information, you can help them greatly.

mefedron sklep

Informative and precise Its hard to find informative and accurate information but here I noted

vans shoes

I enjoy you because of all your valuable effort on this web page. My mum really loves carrying out internet research and it’s really easy to see why. A lot of people notice all regarding the compelling medium you render sensible tips and tricks via the web blog and as well encourage participation from website visitors about this matter then our own daughter is in fact becoming educated a great deal. Enjoy the rest of the year. Your carrying out a great job.

van chuyen hang di ha noi

I simply could not depart your website before suggesting that I extremely enjoyed the usual information an individual provide to your visitors? Is gonna be again continuously to check out new posts.

https://www.prospernoah.com/amazon-affiliate-program-in-nigeria/

Im obliged for the blog post.Really looking forward to read more. Really Cool.

how to get help in windows 10

Hi there friends, its impressive post about tutoringand fully

defined, keep it up all the time.

Wakanda.ng review

Well I really enjoyed studying it. This article offered by you is very practical for proper planning.

adidas stan smith

A lot of thanks for all your effort on this blog. Betty loves participating in research and it’s really easy to understand why. I hear all regarding the powerful means you offer effective thoughts through your website and in addition inspire participation from some others about this subject then our favorite princess is truly becoming educated so much. Take advantage of the remaining portion of the new year. Your conducting a great job.

nnu income

Thanks for the article post.Thanks Again. Cool.

https://www.prospernoah.com/affiliate-programs-in-nigeria/

Thanks-a-mundo for the article post.Really thank you! Awesome.

how to get help in windows 10

What a information of un-ambiguity and preserveness of valuable familiarity regarding unexpected emotions.

Christinia

Only wanna remark that you have a very nice site, I enjoy the layout it actually stands out.

golden goose sneakers

I definitely wanted to write down a small note to be able to thank you for all of the unique ways you are giving here. My considerable internet research has at the end been compensated with beneficial knowledge to exchange with my company. I ‘d repeat that we website visitors are extremely lucky to exist in a decent website with many wonderful individuals with very helpful secrets. I feel somewhat lucky to have seen the site and look forward to some more pleasurable moments reading here. Thanks a lot once more for all the details.

Maryjo

Thanks again for the article.Really looking forward to read more. Want more.

porn movie

Wow, fantastic blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is wonderful, as well as the content!

how to get help in windows 10

Your method of explaining everything in this post is in fact nice, all can effortlessly understand it,

Thanks a lot.

yeezy 500 blush

I must show my appreciation for your generosity for individuals who require guidance on this idea. Your real dedication to passing the solution up and down has been wonderfully important and have truly empowered employees just like me to reach their goals. Your own warm and helpful guidelines means a lot a person like me and much more to my fellow workers. Thank you; from all of us.

programa de afiliados web

Very nice article. I definitely love this site. Continue the good work!

games

very good publish, i definitely love this web site, carry on it

for details

Thanks for sharing, this is a fantastic blog.Really looking forward to read more. Awesome.

plenty of fish dating site

For newest news you have to visit the web and on internet I found this website as a most excellent web page for most recent updates.

termogenicos importados

Appreciate you sharing, great blog.Really looking forward to read more. Want more.

ormekur

I cannot thank you enough for the article post.Much thanks again.

plenty of fish dating site

Hey there! I know this is kinda off topic but I was

wondering which blog platform are you using for this website?

I’m getting tired of WordPress because I’ve had issues with hackers and

I’m looking at options for another platform. I would be great if you could point me in the direction of

a good platform.

answer

Im obliged for the blog post.Much thanks again. Want more.

buy facebook account

Really appreciate you sharing this blog.Much thanks again. Much obliged.

Alline

It as not that I want to duplicate your web-site, but I really like the design. Could you let me know which theme are you using? Or was it especially designed?

Stepnot

Cialis E Occhio Cialis 5 Mg Cost Buy Cheap Ciplox 500 Mg viagra Ordering Tamoxifen And Clomid Propecia Impotencia Cialis Levitra

Terrie

Thank you for your article.Thanks Again. Awesome.

plenty of fish dating site

I always used to study piece of writing in news papers but now as I

am a user of web so from now I am using net for articles or

reviews, thanks to web.

Short Term Capital

Enjoyed every bit of your article post.Thanks Again. Want more.

Adele

There is clearly a bunch to identify about this. I believe you made some nice points in features also.

Tamica

We stumbled over here from a different site and thought I should check things out. I such as what My partner and i see so i am just following anyone. Look forwards to looking at your site repeatedly.

Kati

I truly enjoy examining on this site, it has fantastic articles.

liteblue login

Hey, thanks for the blog.Thanks Again. Keep writing.

how to get help in windows 10

What’s up, I check your blogs on a regular basis.

Your writing style is awesome, keep up the

good work!

liteblue

I am so grateful for your blog.Really looking forward to read more. Fantastic.

eebest8 seo

Of course, what a great blog and educative posts, I will bookmark your website.All the Best!

eebest8 fiverr

how to get help in windows 10

Does your website have a contact page? I’m having problems locating

it but, I’d like to shoot you an e-mail. I’ve got some suggestions for your blog you might be interested in hearing.

Either way, great site and I look forward to seeing it

expand over time.

Best Martial Arts school in Natomas

I really like and appreciate your blog article.Much thanks again. Cool.

roblox promo codes hat

Wow, wonderful blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is fantastic, let alone the content!

jufe 088

It as the little changes that will make the biggest changes. Thanks for sharing!

JUFE-085

You ave made some decent points there. I checked on the internet for additional information about the issue and found most individuals will go along with your views on this website.

natalielise

First off I want to say awesome blog! I had a quick question in which I’d like to ask if you do not mind.

I was interested to know how you center yourself and clear your

thoughts before writing. I’ve had a hard time clearing my thoughts in getting my thoughts

out there. I truly do enjoy writing but it just seems

like the first 10 to 15 minutes are generally wasted simply just trying to figure out how to begin. Any suggestions or hints?

Thank you! natalielise plenty of fish

RCTD-252

There is clearly a bunch to identify about this. I think you made certain nice points in features also.

promo codes for allegiant air flights

With thanks! A good amount of information!

seo services

Im grateful for the article.Much thanks again. Want more.

plenty of fish dating site

Great article, totally what I wanted to find.

vudu movie codes

It?s an important Hello! Wonderful post! Please when I could see a follow up!

skillz promo code 2020

phase I take care of such information a lot. I used to be seeking this certain info for a long time.

oakley si promo code 2019

This is one awesome blog article.Really looking forward to read more. Awesome.

contemporary

Thanks for the post.Really thank you! Cool.

spothero monthly parking promo code

Pretty! This was an incredibly wonderful article. Thanks for supplying this info.|

plenty of fish dating site

My brother recommended I may like this web site. He used

to be totally right. This publish truly made my day.

You cann’t imagine just how so much time I had

spent for this info! Thanks!

carseat canopy whole caboodle coupon code

pretty helpful stuff, overall I think this is well worth a bookmark, thanks

ray bans sale mens

Well I definitely enjoyed reading it. This subject provided by you is very useful for accurate planning.

thrifty car rental jfk

You, my pal, ROCK! I found just the information I already searched all over the place and simply could not find it. What a great web site.

flexjobs groupon

I wanted to thank you for this fantastic write-up, I definitely loved every little bit of it. I ave bookmarked your web site to look at the latest stuff you post.

http://duvporno.biz/

Very neat post.Much thanks again. Really Cool.

mgemi promo code

on other sites? I have a blog centered on the same information you discuss and would really like to

poshmark invite code

On a geographic basis, michael kors canada is doing a wonderful job

http://moviesporno.net/

Great, thanks for sharing this article post.Much thanks again. Great.

in catalogue tai ha noi

Looking forward to reading more. Great blog post. Awesome.

jet's coupon

wonderful points altogether, you simply won a new reader. What might you suggest in regards to your submit that you just made some days ago? Any sure?

marco coupons

Very informative post.Really thank you! Fantastic.

cv coupons

Thanks again for the article post.Really looking forward to read more. Great.

cheggs coupon

This very blog is obviously entertaining as well as amusing. I have picked helluva interesting things out of this blog. I ad love to go back again and again. Thanks a lot!

plenty of fish dating site

Wonderful post however I was wondering if you could write a

litte more on this subject? I’d be very grateful if you could elaborate a little bit more.

Kudos!

inlineskates kaufen

Thank you for your blog article.Thanks Again. Want more.

seo vancouver

Looking around I like to look around the web, regularly I will just go to Stumble Upon and follow thru

http://sporthealthylife.com/

I appreciate you sharing this article post.Thanks Again. Great.

SEO Vancouver

Sweet blog! I found it while browsing on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I ave been trying for a while but I never seem to get there! Appreciate it

SEO Vancouver

Whoa! This blog looks exactly like my old one! It as on a totally different subject but it has pretty much the same layout and design. Superb choice of colors!

SEO Vancouver

post and a all round exciting blog (I also love the theme/design), I don at have time to look

SEO Vancouver

Just wanna admit that this is handy , Thanks for taking your time to write this.

smore.com

Everything is very open with a very clear clarification of

the challenges. It was really informative. Your website is extremely helpful.

Thanks for sharing! natalielise plenty of fish

SEO Vancouver

Major thanks for the article post.Really looking forward to read more. Keep writing.

shower doors frameless

Major thanks for the blog article.Really looking forward to read more. Will read on

SEO Vancouver

Very fantastic info can be found on website.

coupon for tommy hilfiger outlet in store

There is definately a lot to find out about this issue. I really like all the points you made.

dollar car rental orlando promo code

This is a topic that is close to my heart Take care! Where are your contact details though?

Current Check promo code dec

I thought it was going to be some boring old publish, but it really compensated for my time. I will publish a link to this page on my weblog. I am sure my visitors will find that really useful

JUY-945

I really enjoy the blog. Keep writing.

SEO Vancouver

You made some clear points there. I did a search on the topic and found most guys will approve with your site.

SEO Vancouver

wonderful issues altogether, you just won a new reader. What could you suggest about your publish that you made some days ago? Any positive?

qustodio discount code

informative. I am gonna watch out for brussels.

SEO Vancouver

Wow, wonderful blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is great, let alone the content!

fabletics promo code april 2019

Looking forward to reading more. Great article.Thanks Again. Awesome.

SEO Vancouver

It is really a nice and useful piece of information. I am glad that you shared this useful info with us. Please keep us informed like this. Thanks for sharing.

plumpaper2019

You ave an extremely good layout for your blog i want it to use on my internet site also.

JimmyJohns

Say, you got a nice article post.Really thank you! Cool.

Bubble Shooter

You are my inhalation , I own few blogs and often run out from to post.

elbise giydirme

Where I am from we don at get enough of this type of thing. Got to search around the entire globe for such relevant stuff. I appreciate your effort. How do I find your other articles?!

Balon Patlatma

You have made some really good points there. I checked on the net for more information about the issue and found most people will go along with your views on this website.

Amigo Infoservices Twitter

Very neat article post.Really looking forward to read more. Really Cool.

Amigo Infoservices Linkedin

Rattling clean internet internet site , appreciate it for this post.

realistic dildo

This is one awesome article.Really thank you! Awesome.

FreePeople discount

There is noticeably a bundle to learn about this. I assume you made sure nice points in features also.

ovusenseCodes

The Constitution gives every American the inalienable right to make a damn fool of himself.

fox rent a car coupons

Say, you got a nice blog post.Much thanks again. Great.

promo code for birkenstock uk

Wohh just what I was looking for, appreciate it for posting.

mcgraw hill promo code for connect

You have got a really nice layout for your blog i want it to utilize on my web site also.

best male sex toy

Thanks-a-mundo for the article post.Really looking forward to read more. Cool.

lumber liquidators coupon butcher block

Thank you ever so for you blog post.Thanks Again. Want more.

shari's berries free shipping 2019

I really liked your blog.Much thanks again. Fantastic.

classic car wash florence ky

Wholesale Mac Makeup ??????30????????????????5??????????????? | ????????

columbia outlet store printable coupons

Im no professional, but I believe you just made an excellent point. You obviously know what youre talking about, and I can actually get behind that. Thanks for staying so upfront and so honest.

free shipping and handling proflowers

I think this is a real great blog post.Thanks Again. Fantastic. ventolin

hill's science diet kd coupon

you will have an ideal weblog right here! would you like to make some invite posts on my blog?

coupon for american eagle printable nov

This is one awesome blog.Much thanks again. Awesome.

doctor on demand flu coupon

Major thanks for the article.Thanks Again. Cool.

plus size women dildo

I truly appreciate this blog post.Really thank you! Will read on…

Displays to go coupon

wow, awesome post.Much thanks again. Want more.

Hundeseng

Im grateful for the article.Thanks Again. Really Great.

SEO Vancouver

Pretty! This was an extremely wonderful article. Thank you for supplying this information.

Home gym flooring

I really enjoy the article.Much thanks again. Really Great.

sky zone groupon van nuys

There is definately a great deal to know about this topic. I really like all of the points you have made.

free people near me

Saved as a favorite, I really like your site!

postmates promo code portland

Perfect piece of work you have done, this web site is really cool with wonderful info.

Promo Codes Peoria Charter

Looking forward to reading more. Great post.Thanks Again. Much obliged.

stubhub promo code barstool

I was recommended this blog by my cousin. I am not sure whether this post is written by him as nobody else know such detailed about my trouble. You are incredible! Thanks!

open ended penis stroker

Really appreciate you sharing this article post.Much thanks again. Really Cool.

https://www.youtube.com/watch?v=zi5IEYdRREw&t=45s

It is racist to deny Whites & Arabs are a mix of blond haired blue eyed white skinned Nordics and the Indian race, do you agree?

sky zone coupon discount

Thanks-a-mundo for the blog.Really thank you! Awesome.

paladins promo code giveaway

wow, awesome blog post.Really looking forward to read more. Keep writing.

mcgraw hill connect promo code reddit 2017

Your mode of explaining the whole thing in this post is in fact good, every one be able to simply be aware of it, Thanks a lot.

dildo challenge

Thank you for your post. Really Cool.

love nikki dress up queen code

This site really has all the info I needed concerning this subject and didn at know who to ask.

promo code for volaris.com.mx

Looking around I like to browse around the web, often I will just go to Stumble Upon and follow thru

stubhub coupon code reddit

Woman of Alien Perfect get the job done you have got completed, this site is de facto great with great data. Time is God as strategy for maintaining every little thing from going on directly.

best dildo review

Great article.Really thank you! Much obliged.

waitr promo code december

I’аve recently started a web site, the information you provide on this web site has helped me greatly. Thank you for all of your time & work.

roblox promo codes 2019 list

Thanks for sharing, this is a fantastic article.Thanks Again. Great.

coupon code

wow, awesome article. Want more.

touch up direct coupon

Wow, what a video it is! Truly good feature video, the lesson given in this video is really informative.

bitesquad coupon june 2019

There are many ways to do this comparable to providing unique

Recommended Reading

Muchos Gracias for your article post.Really thank you! Awesome.

ubereats first time promo code sydney

What as up, I read your new stuff daily. Your writing style is awesome, keep doing what you are doing!

tillys promo code march 2018

You ave made some really good points there. I looked on the internet for more information about the issue and found most people will go along with your views on this web site.

removals preston

Thanks for the blog.Really looking forward to read more. Want more.

cheaper than dirt promo code october 2018

Im obliged for the article.Really looking forward to read more. Really Cool.

SEO Vancouver

This is really interesting, You are a very skilled blogger. I ave joined your rss feed and look forward to seeking more of your excellent post. Also, I ave shared your site in my social networks!

dating site

I like the helpful information you provide in your articles.

I’ll bookmark your weblog and check again here regularly. I

am quite certain I’ll learn a lot of new stuff right here!

Good luck for the next!

teamviewer 14 skachat besplatno na russkom

What web host are you the use of? Can I get your associate hyperlink in your host?

Commerce Tutor

Really enjoyed this blog article.Much thanks again. Really Great.

teamviewer 14 skachat besplatno na russkom

Test to try to eat truly difficult food items that are equipped to

SEO

I went over this internet site and I believe you have a lot of superb information, saved to bookmarks (:.

What is SEO

Wow, marvelous weblog structure! How lengthy have you ever been blogging for? you made running a blog glance easy. The whole look of your website is magnificent, let alone the content!

kitchen design

Wow, this article is good, my sister is analyzing such things, so I am going to inform her.

newsaper ad agency

Thanks for sharing this fine write-up. Very interesting ideas! (as always, btw)

cheap viagra in australia

It as hard to find educated people on this topic, but you seem like you know what you are talking about! Thanks

dating site

We are a group of volunteers and opening a new scheme in our

community. Your web site offered us with helpful information to work on. You’ve performed an impressive process

and our whole community will be grateful to you.

viagra australia

It as amazing for me to have a web page, which is good in support of my knowledge. thanks admin

Janice

I am a mother and I really needed this info thanks!

SEO Vancouver

Thanks for sharing, this is a fantastic blog post.Thanks Again. Cool.

apps download for windows 10

Im no expert, but I think you just made an excellent point. You undoubtedly fully understand what youre talking about, and I can really get behind that. Thanks for being so upfront and so honest.

Album Downloads

Normally I do not read article on blogs, but I wish to say that this write-up very forced me to take a look at and do it! Your writing taste has been surprised me. Thank you, quite great article.

SEO Vancouver

Really enjoyed this blog post.Much thanks again. Will read on

bbc world news

Muchos Gracias for your article.Really thank you!

SEO Vancouver

I think other web-site proprietors should take this site as an model, very clean and excellent user friendly style and design, let alone the content. You are an expert in this topic!

dating site

I have to thank you for the efforts you’ve put in writing this blog.

I am hoping to view the same high-grade content by you later on as well.

In truth, your creative writing abilities has motivated me to

get my own, personal site now 😉

free download for windows 8

Just Browsing While I was surfing yesterday I noticed a great post concerning

USA

Fantastic post.Really thank you! Will read on…

SEO Vancouver

I think other site proprietors should take this web site as an model, very clean and wonderful user genial style and design, as well as the content. You are an expert in this topic!

cciso book

wow, awesome article post. Really Great.

cciso certification

This blog is really entertaining and besides amusing. I have discovered a lot of handy advices out of it. I ad love to return again and again. Cheers!

Text Chemistry Examples

Some times its Some times its a pain in the ass to read what blog owners wrote but this site is rattling user friendly !.

SEO Vancouver

Muchos Gracias for your post.Really looking forward to read more. Really Great.

plenty of fish

After exploring a few of the blog articles on your blog, I really like

your technique of writing a blog. I saved it to my bookmark site list and will be checking back soon. Please visit my

web site too and tell me your opinion.

bistromasa

Thank you ever so for you article post.Much thanks again. Will read on

hoa don dien tu

This is a very good tip especially to those fresh to the blogosphere. Simple but very precise info Thanks for sharing this one. A must read article!

SEO Vancouver

Thanks again for the blog post.Really looking forward to read more. Awesome.

SEO Vancouver

This blog is really awesome as well as diverting. I have chosen many useful things out of this amazing blog. I ad love to visit it every once in a while. Thanks a lot!

plenty of fish https://natalielise.tumblr.com

Hi there, I think your site may be having internet browser compatibility

problems. When I look at your web site in Safari,

it looks fine however when opening in I.E., it has some overlapping issues.

I just wanted to provide you with a quick heads up!

Besides that, wonderful blog! natalielise

pof

SEO Vancouver

I think this is a real great blog article.Really looking forward to read more. Great.

SEO Vancouver

I think this is a real great post.Thanks Again. Will read on

cua nhua gia go

Whoa! This blog looks just like my old one! It as on a totally different topic but it has pretty much the same page layout and design. Great choice of colors!

Hoa don dien tu

to write some content for your blog in exchange for a link back to

read more

This blog is really entertaining additionally amusing. I have picked up a bunch of helpful advices out of it. I ad love to come back again and again. Thanks!

read more

Please forgive my English.You completed various good points there. I did a search on the subject matter and found the majority of people will consent with your blog.

plenty of fish https://natalielise.tumblr.com

My spouse and I absolutely love your blog and find most of

your post’s to be just what I’m looking for.

can you offer guest writers to write content in your case?

I wouldn’t mind writing a post or elaborating on a few

of the subjects you write regarding here. Again, awesome weblog!

natalielise plenty of fish

(passwrd: gianna)

I value the post.Thanks Again. Really Cool.

Vacancy for Home Tutor in Hazaribagh

Great post.Much thanks again. Much obliged.

buytramadolonlineusa

I really enjoy the blog post. Fantastic.

ABP 893

This is one awesome blog.Much thanks again.

nicole murphy

Really informative blog post.Thanks Again. Really Cool.

sex toy

I cannot thank you enough for the blog.Really thank you!

Adam Eve coupon groupon

wow, awesome article.Much thanks again. Want more.

diy vibrator

Im grateful for the blog article. Fantastic.

latest news about tech

I value the post.Really thank you! Much obliged.

Rublennyj dom v Moskve

Major thankies for the blog post.Thanks Again. Great.

Janae

I relish, result in I found exactly what I used to be having a look for. You have ended my four day lengthy hunt! God Bless you man. Have a nice day. Bye

Boston Car Service

I really enjoy the article.Really thank you! Want more.

catering hall queens

Major thanks for the blog post.Much thanks again.

Ormekur til kat

I value the blog article.Thanks Again. Great.

screens for laptops

It is not acceptable just to think up with an important point these days. You have to put serious work in to exciting the idea properly and making certain all of the plan is understood.

maze game scary

Very interesting topic , thanks for putting up.

proizvodstvo polietilena

This is a good tip especially to those new to the blogosphere. Brief but very precise information Appreciate your sharing this one. A must read post!

Get Google First Spots Cheap SEO

Thanks for sharing, this is a fantastic post.Really looking forward to read more. Will read on

ايجي بست

Im grateful for the blog post.Really thank you!

Get More Information

Muchos Gracias for your blog.Really looking forward to read more. Really Great.

cantilever racking brisbane

These are truly great ideas in about blogging. You have touched some nice factors here. Any way keep up wrinting.

scariest maze

Well I truly enjoyed studying it. This information provided by you is very practical for correct planning.

https://www.youtube.com/

Thanks a lot for the blog article.Really looking forward to read more. Awesome.

Office Removal Companies

This excellent website certainly has all the info I wanted about this subject and didn at know who to ask.

for more information

Would appreciate to constantly get updated great blog !.

for more info

Very very good publish, thank that you simply lot regarding sharing. Do you happen a great RSS feed I can subscribe to be able to?

to read more

You have observed very interesting details ! ps nice web site. I understand a fury in your words, But not the words. by William Shakespeare.

메이저토토

Very neat blog article.Thanks Again. Really Great.

optimize your search engine

Im thankful for the blog post.Thanks Again. Really Cool.

search engine optimization tutorial pdf

You made some first rate points there. I regarded on the web for the problem and located most people will associate with together with your website.

weld positioner

The issue is something which too few people are speaking intelligently about.

mechanical engineering designs

I really liked your blog post.Really thank you! Want more.

SSNI 563

Appreciate you sharing, great blog post. Really Great.

dau phun may in mau epson a3

Keep up the fantastic piece of work, I read few content on this internet site and I conceive that your site is rattling interesting and has circles of superb information.

maca peruana tribulus terrestris

This is one awesome post.Much thanks again. Much obliged.

Polycrystalline silicon solar

I truly appreciate this blog. Fantastic.

EZ Battery Reconditioning Reviews

I truly appreciate this article. Much obliged.

positions during sex

Im grateful for the article post.Really thank you! Great.

final deal

Just wanna input that you have a very nice website , I the layout it really stands out.

buy tramadol online

Thanks so much for the post.Thanks Again. Will read on…

youtube seo course in telugu

In order to develop search results ranking, SEARCH ENGINE OPTIMISATION is commonly the alternative thought to be. Having said that PAID ADVERTISING is likewise an excellent alternate.

plenty of fish dating site

Touche. Outstanding arguments. Keep up the good effort.

Singapore Tattoo

There is perceptibly a bunch to realize about this. I feel you made certain nice points in features also.

know more

wow, awesome blog post.Much thanks again. Really Cool.

make money online affiliate programs

Thank you for the article!! It was very informative and inspiring! The more information we can share, is the wealthier we’ll all be! Wealth is your birthright!! Here’s a great way I found to become financially free via online business : https://bit.ly/2GVrvHp

SEO Vancouver

in our community. Your site offered us with helpful information to

plenty of fish dating site

Currently it appears like Expression Engine is the top blogging platform out there right now.

(from what I’ve read) Is that what you are using on your blog?

plenty of fish dating site

This design is incredible! You most certainly know how to keep a reader amused.

Between your wit and your videos, I was almost moved

to start my own blog (well, almost…HaHa!) Wonderful job.

I really loved what you had to say, and more than that, how

you presented it. Too cool!

Willette Mannchen

https://legal-porno.blogspot.com/2019/05/naughty-nurse-thoroughly-washing-cock.html

MIAA-150

Im grateful for the post.Much thanks again. Great.

this website

Really enjoyed this blog post.Much thanks again. Much obliged.

1

I cannot thank you enough for the blog post. Great.

https://www.prospernoah.com/nnu-forum-review//

Your style is so unique in comparison to other folks I ave read stuff from. Many thanks for posting when you ave got the opportunity, Guess I will just book mark this blog.

bouncy castle service in hammersmith area

Very good blog.Thanks Again. Cool.

NNU forum

indeed, as bryan caplan suggests, in the past the zeal of an insurer to guard

video production

I cannot thank you enough for the blog article.Much thanks again. Great.

bdsm bondage

Really informative article post.Really looking forward to read more. Fantastic.

Trigona

I cannot thank you enough for the article.Much thanks again. Keep writing.

adam and eve challenge

Major thankies for the article.Really looking forward to read more. Want more.

suelo tecnico precio m2

You are so awesome! I do not think I have read a single thing like that before. So great to find someone with a few unique thoughts on this topic.

pegging men

Thanks for sharing, this is a fantastic blog article.Thanks Again. Really Great.

voyance amour

Very good article. Great.

minecraft games

Do you have a spam problem on this site; I also

am a blogger, and I was wondering your situation; we have

created some nice methods and we are looking to

trade methods with others, please shoot me an e-mail if interested.

NIW attorney

Thanks for the post.Much thanks again. Really Great.

descargar facebook

If you desire to take much from this article then you have to apply these methods to your

won weblog.

Alayna Harkleroad

Say, you got a nice blog.Really looking forward to read more. Really Great.

Movie Rating

informative blog

empresas de limpieza en santa cruz

You may surely see your skills in the paintings you create. The arena hopes for all the more passionate writers like you who are not afraid to say how they think. Generally go soon after your heart.

Life Insurance Surrey

I really liked your article.Much thanks again. Keep writing.

imessage for pc

There as certainly a lot to learn about this topic. I really like all the points you made.

descargar facebook

I read this article completely concerning the comparison of most up-to-date and previous technologies, it’s awesome article.

HGOT 008

Thanks-a-mundo for the blog post.Really looking forward to read more. Awesome.

lead generation strategies

send this post to him. Fairly certain he will have a good read.

Movie Ranking

thank you very much

big bouncy castles hammersmith

Hey, thanks for the blog post.

search engine optimization

This blog helped me broaden my horizons.

SSNI 574

Rattling good information can be found on weblog.

Marketing

Major thankies for the blog post.Really looking forward to read more. Really Great.

SSNI 577

Say, you got a nice blog.Thanks Again. Want more.

website laten maken

amazing article

tsx

Wow, marvelous blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is magnificent, as well as the content!. Thanks For Your article about sex.

Vancouver SEO

My brother suggested I might like this blog. He was entirely right. This post actually made my day. You can not imagine simply how much time I had spent for this information! Thanks!

comprar zapatillas airmax baratas

amazing article

Boston Car Service

Really informative article.Really thank you! Cool.

comprar viajes baratos

thank you very much

comprar zapatillas air max

informative blog

walmartone.com

Looking forward to reading more. Great article post.Thanks Again. Great.

comprar zapatillas air max

thank you very much

https://giaogasquan2.com/

My brother suggested I might like this website. He was totally right. This post truly made my day. You cann at imagine simply how much time I had spent for this information! Thanks!

negative interest rates

Wow! This can be one particular of the most useful blogs We ave ever arrive across on this subject. Basically Fantastic. I am also a specialist in this topic therefore I can understand your effort.

Instagram Video İzlenme Hilesi

https://medium.com/@takipciishop/instagram-viCC87deo-iCC87zlenme-hiCC87lesiCC87-gC3B6rC3BCntC3BClenme-takipcishop-a767522c530b

pink bouncy castle Lewisham

Hey, thanks for the blog post.Really looking forward to read more.

JAV

There is definately a lot to learn about this subject. I really like all the points you have made.

Instagram Video İzlenme Hilesi

Instagram Video İzlenme Hilesi

TakipciShop

TakipciShop Instagram takipçi satın almanın en hızlı ve uygun yolu

http://bit.ly/2yKJuvq

http://bit.ly/2yKJuvq

SEO Vancouver

Thanks for sharing, this is a fantastic article post.Really thank you! Really Cool.

http://bit.ly/2Ksze0E

http://bit.ly/2Ksze0E

bouncy castle with slide hire Bexley

I value the blog post.Thanks Again. Awesome.

Badosa

This is definitely a wonderful webpage, thanks a lot..

Mavi Ekran

https://www.maviekran.net/facebook-hesabini-kalici-olarak-silmek/

como hacer una aplicacion movil

Thank you for your blog article.Thanks Again. Really Cool.

Optimizatsiya na saitove

The methods stated in this paragraph concerning to increase traffic at you own web site are actually pleasant, thanks for such pleasant post.

c_cp_i_12 - sap certified application associate - sap cloud platform integration

When I look at your blog in Safari, it looks fine but

project plus

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your wonderful post. Also, I have shared your web site in my social networks!

c_cp_i_12 - sap certified application associate - sap cloud platform integration

Looking forward to reading more. Great blog article. Will read on

quest bars cheap

I think this is one of the most vital info for me. And i am glad reading your article.

But should remark on some general things, The website style is great,

the articles is really excellent : D. Good job, cheers

quest bars cheap

Thanks very nice blog!

tax and business services

You made some clear points there. I did a search on the subject matter and found most guys will consent with your site.

ABP 900

Really informative article post.Much thanks again. Really Great.

quest bars cheap

What’s up friends, its impressive article

concerning teachingand fully defined, keep it up all the time.

SW 656

Well I definitely liked studying it. This subject provided by you is very constructive for accurate planning.

HND 726

Thank you ever so for you article. Great.

STARS 128

Some really excellent content on this internet site , thanks for contribution.

STARS-122

Well I definitely enjoyed reading it. This post provided by you is very constructive for correct planning.

simpliesgoto.pt

informative blog

casareparacoes.pt

thank you very much

JUY-974

Really appreciate you sharing this blog.Much thanks again. Fantastic.

STARS-117

I truly appreciate this article.Thanks Again. Really Cool.

yellow pages UK

This is one awesome blog article.Really thank you! Cool.

สมัคร vegus168

Hey, thanks for the blog article.Thanks Again. Really Great.

Ways to earn money

amazing article

Ways to earn money

amazing article

do this

Some truly quality articles on this site, saved to bookmarks.

hotmail login

Say, you got a nice blog.Really thank you! Great.

click reference

Terrific post however , I was wondering if you could write

rummy

thank you very much

tax evasion sentence

This unique blog is no doubt awesome additionally factual. I have found many handy stuff out of it. I ad love to return every once in a while. Thanks a bunch!

reformas de cocinas en madrid

It as very easy to find out any topic on web as compared to textbooks, as I found this piece of writing at this website.

cerita dewasa tetangga

Thanks for sharing, this is a fantastic blog post. Much obliged.

working coupon

I appreciate you sharing this blog article.Much thanks again. Cool.

Avoid this company

Thanks so much for the article post.Much thanks again. Keep writing.

vegus168 bet

Thanks so much for the article.Really thank you!

SEO Consultant Vancouver

Keep up the fantastic work , I read few articles on this web site and I think that your web site is really interesting and contains lots of wonderful info .

SEO Vancouver

Major thankies for the blog.Thanks Again. Great.

site de voyance gratuite amour

You made some good points there. I did a search on the topic and found most persons will go along with with your site.

เวกัส 168

Hey, thanks for the blog post.Really looking forward to read more. Cool.

Removal Companies South London

This particular blog is no doubt awesome and besides diverting. I have picked many interesting stuff out of it. I ad love to come back again and again. Thanks!

Job seeking

Thank you for every other great post. The place else may just anyone get that type of info in such a perfect way of writing? I ave a presentation next week, and I am at the look for such info.

bouncy castle rental near Bexley

Really informative blog.Really looking forward to read more. Awesome.

extended auto warranty

I really liked your post.Much thanks again. Cool.

victoria hearts dating site